Storm in Sight: Navigating the U.S. Outlook Under Tariff-Induced Uncertainty

Northern Trust’s Global Economic Research team assesses the mixed macro signals following aggressive U.S. tariff actions, highlighting implications for growth, inflation, and monetary policy.

Key Insights:

-

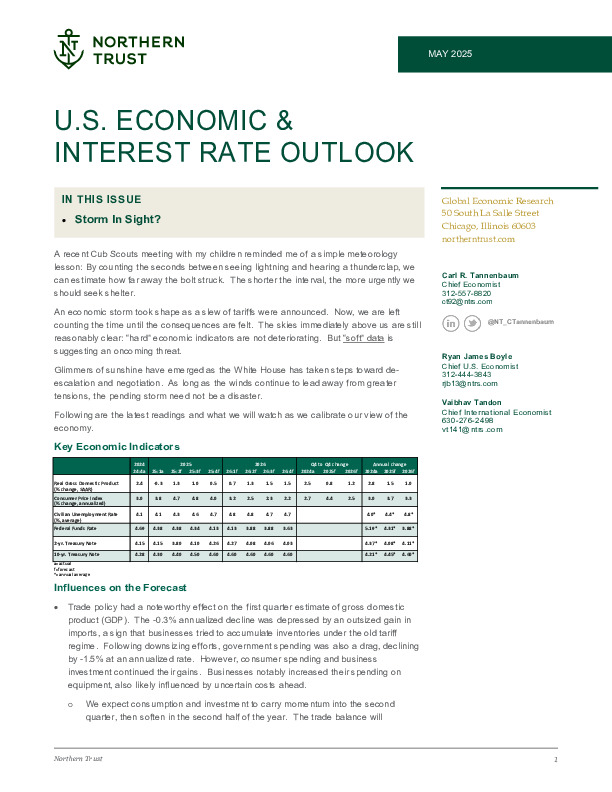

Q1 GDP Shrinks: A -0.3% contraction driven by tariff-related import surges and weak government spending; consumption and investment remain resilient — for now.

-

Labour Market Stable: April added 177,000 jobs; jobless claims and hiring metrics show no immediate stress.

-

Inflation Risks Rising: Core PCE at 2.6% YoY, with Fed research warning trade shocks may elevate inflation for two years.

Read the full report for insights on interest rates, inflation dynamics, and sector-specific vulnerabilities.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.