Structural forces playing out now

The *BlackRock Weekly Investment Commentary (November 2024)* explores current macroeconomic conditions and structural forces shaping markets. Key insights include:

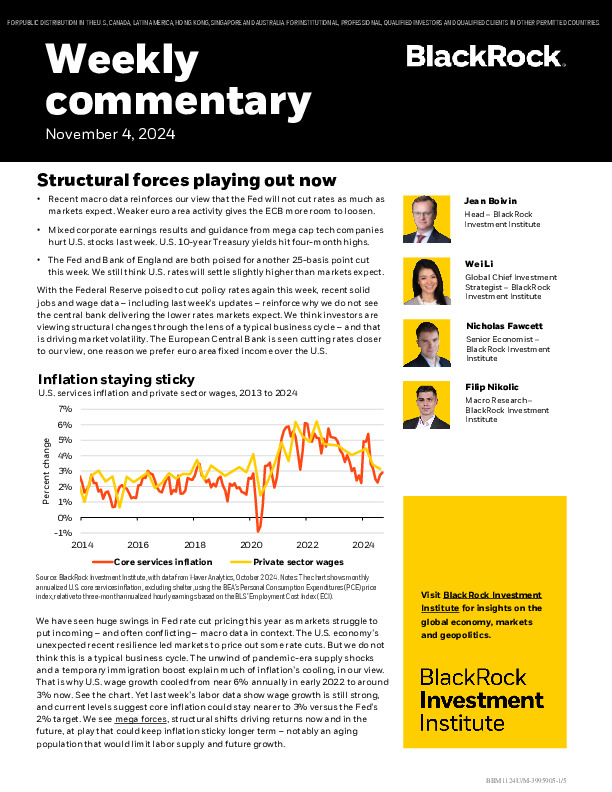

- The Fed is expected to cut rates, but likely less than markets anticipate, due to persistent inflation and labor market strength.

- U.S. Treasury yields are high, with tech earnings underperforming amid elevated valuations.

- Structural forces like demographic shifts, AI disruption, and geopolitical fragmentation are anticipated to maintain inflation pressures long-term.

For a detailed breakdown of these dynamics and investment recommendations, download the full report.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.