Asset Allocation Outlook

The January 2025 Asset Allocation Outlook, authored by Van Lanschot Kempen’s investment team, analyzes global market performance and provides key investment strategies for the year ahead.

Key Highlights:

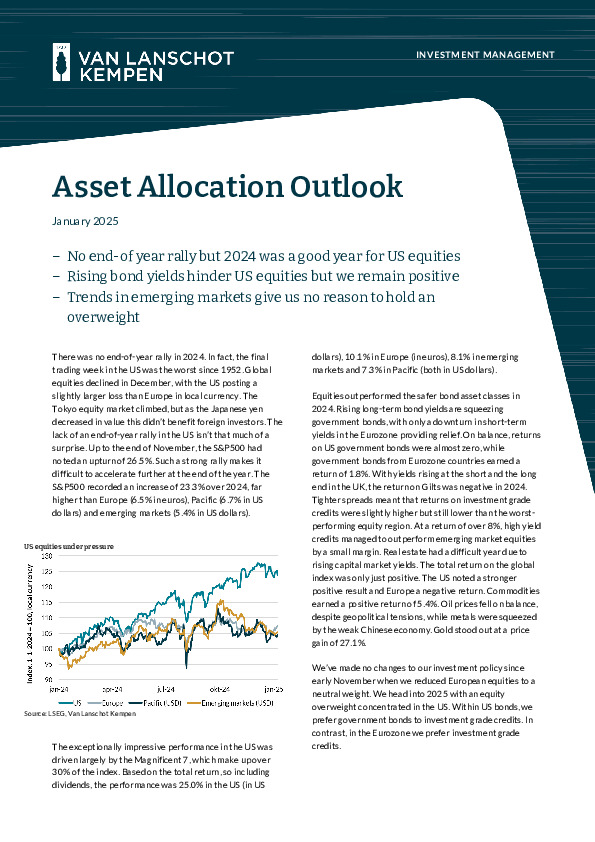

• Equities: Strong 2024 U.S. gains (+23.3%) driven by tech stocks, though tempered by rising bond yields and inflation risks. U.S. equities remain overweight due to strong economic growth.

• Fixed Income: Neutral stance on bonds; U.S. government bonds preferred over investment-grade credits due to tight spreads.

• Emerging Markets:*Underperformance attributed to weak economic growth and policy concerns in China.

• Commodities & Real Estate: Neutral, with real estate affected by rising yields and commodities limited by weak demand.

Access the full report for deeper insights into 2025 strategies.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.