US Debt Trajectory Raises Sustainability Questions — Gold Gains Appeal Amid Fiscal Uncertainty

Invesco’s Global Market Strategy Office, led by Paul Jackson, examines the long-term sustainability challenges of US government debt and highlights gold’s potential role as a strategic hedge.

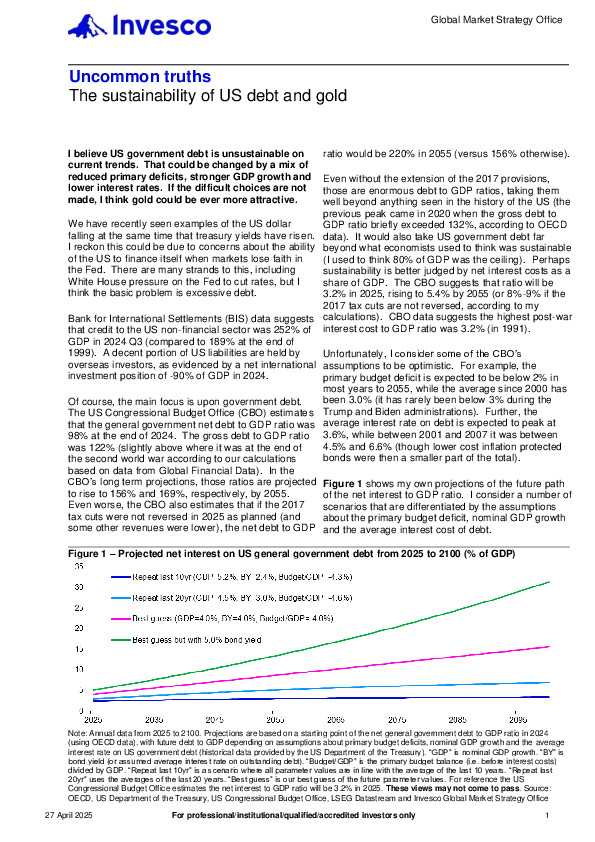

- Debt Outlook Worsening: US debt-to-GDP ratios could exceed 200% by 2055 and reach unsustainable levels without corrective fiscal measures, driven by rising interest costs and structural deficits.

- Limited Policy Options: Realistic solutions—spending cuts, tax increases, demographic boosts—face political and economic hurdles, making debt stabilization difficult.

- Gold as a Hedge: In scenarios of fiscal distress or systemic reset, gold’s allure may increase significantly, with theoretical prices suggesting large upside potential.

Explore the full report to assess how debt dynamics, macro uncertainty, and shifting monetary regimes could reshape asset allocation decisions. Is your portfolio ready for a scenario where gold regains global monetary relevance?

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.