Navigating Trade Turbulence: AI Strength Supports U.S. Equities Amid Supply Disruptions

Authored by BlackRock Investment Institute’s senior research team, this report analyzes market impacts from escalating U.S.-China trade tensions and outlines strategic positioning for investors.

Key Insights:

-

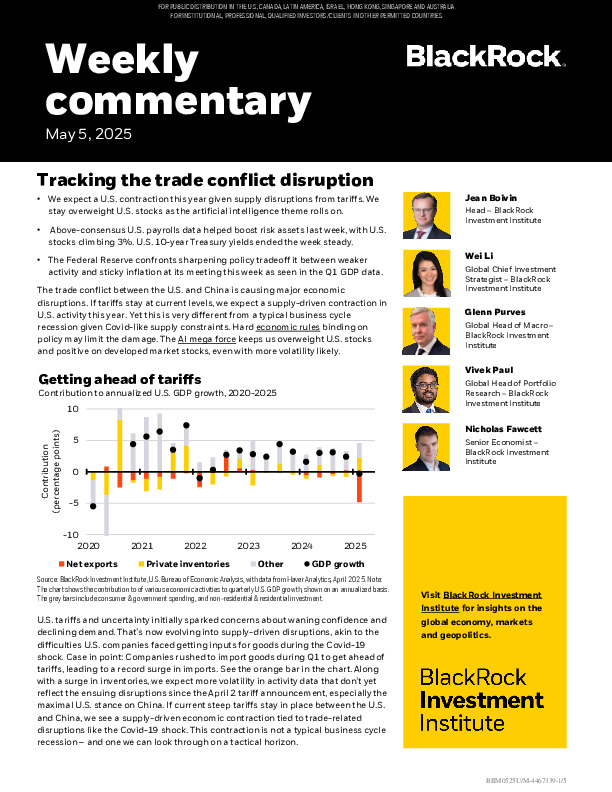

Supply-Driven Contraction Ahead: Tariff-driven disruptions expected to trigger a U.S. slowdown, though unlike typical recessions.

-

AI Mega Force Resilient: Despite trade risks, surging AI demand sustains U.S. equities, keeping them overweight in portfolios.

-

Fed's Policy Dilemma: Sticky inflation vs. weakening growth sharpens trade-offs; rate cuts likely limited.

Understand how global macro forces and AI tailwinds shape portfolio positioning, explore the full document.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.