Tariff Relief Rally: US-UK Deal Signals Market Calm, But Risks Linger

Invesco’s Global Market Strategy Office evaluates the recent US-UK trade deal’s impact on global markets and outlines tactical asset shifts in light of evolving tariff dynamics.

Key Insights:

-

Partial Relief: The US-UK agreement eases select tariffs but leaves a 10% baseline, with broader risks — especially for China — still intact.

-

Economic Drag: A full tariff regime could raise US CPI by up to 3.5% and cut GDP by 2.25%, with recession risks rising.

-

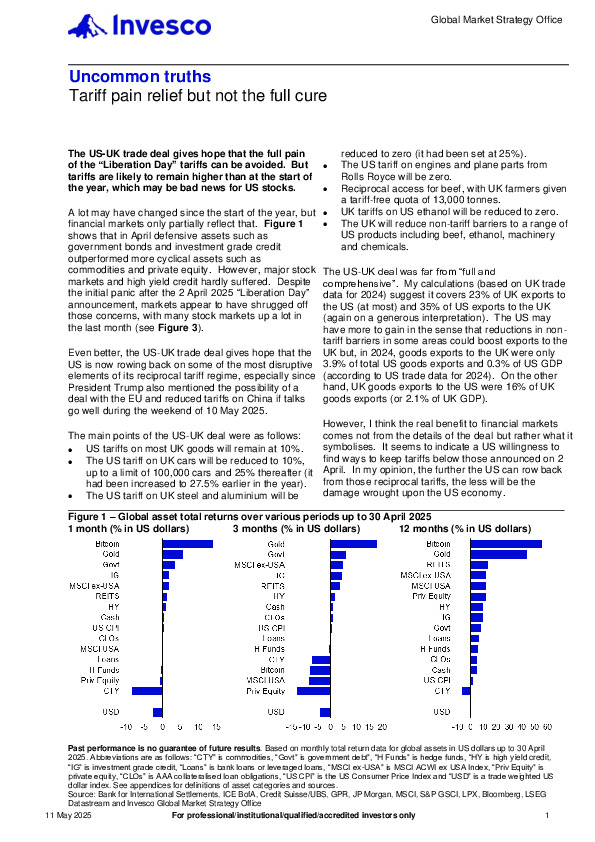

Market Reaction: Despite muted US equity performance YTD, European and Japanese markets have surged, buoyed by fiscal optimism.

Access the full report to explore Invesco’s latest allocation strategies and sector outlooks amid global trade realignment.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.