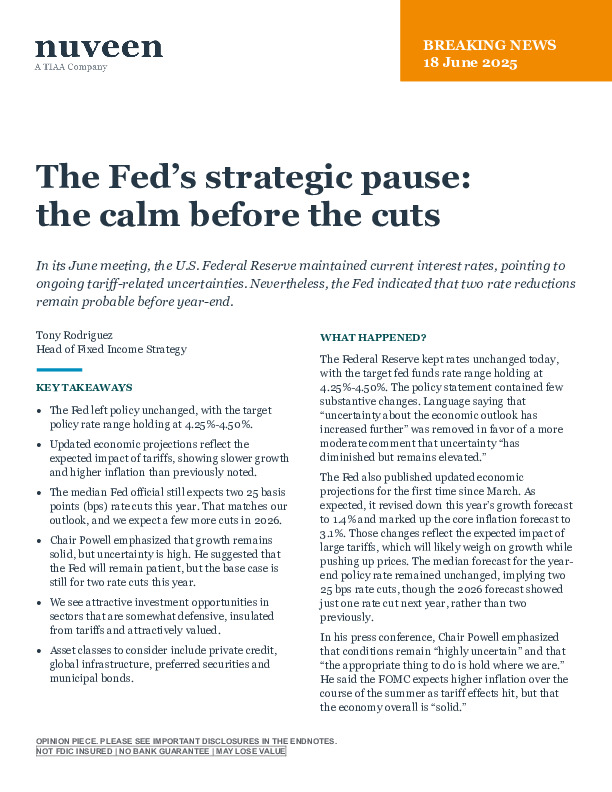

The Fed’s Strategic Pause: Tariff Tensions Set the Stage for Rate Cuts

In this June 2025 outlook, Nuveen’s Tony Rodriguez analyzes the Federal Reserve’s policy pause and the implications of inflation, tariffs, and economic uncertainty for investors.

-

The Fed held rates at 4.25%–4.50% but signaled two cuts likely in 2025 amid tariff-driven inflation and slowing growth.

-

Private credit and infrastructure emerge as attractive asset classes, offering resilience in a mixed macro environment with elevated fiscal and policy risks.

-

Preferred securities and municipal bonds may deliver income and capital gains, supported by robust fundamentals and elevated yields.

Explore the full report for actionable insights on portfolio positioning ahead of a shifting rate environment and widening policy scenarios.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.