Dollar Weakness, Valuation Risk: Vanguard’s Balanced Outlook for Long-Term Investors

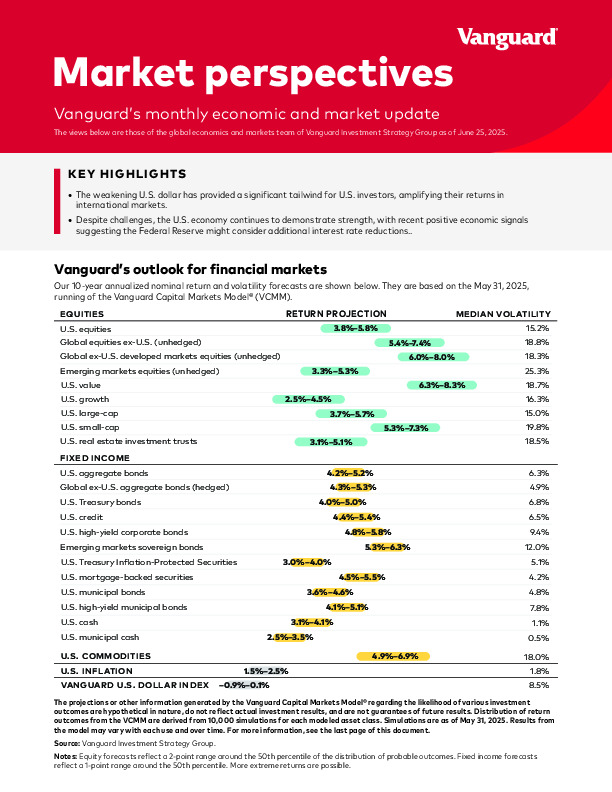

In its July 2025 Market Perspectives, Vanguard’s Investment Strategy Group evaluates global asset class expectations amid a weaker U.S. dollar, evolving rate policy, and rising equity valuations.

-

The U.S. dollar's 8% decline YTD has boosted USD-denominated international returns, particularly in European and emerging market equities.

-

Vanguard forecasts subdued long-term equity returns, with the U.S. equity risk premium nearing zero—implying limited compensation versus bonds.

-

Two Fed rate cuts remain likely in 2025 as inflation moderates and tariff tensions ease, with policy nuance critical for forward guidance.

Which global exposures still offer attractive relative value? Read the full report for Vanguard’s 10-year capital market assumptions.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.