Mastering Bond Risk: Why Duration Matters More Than Maturity

Nuveen's in-depth analysis clarifies how duration provides a more accurate measure of bond volatility than maturity alone, offering valuable insights for fixed income investors navigating rate-sensitive markets.

-

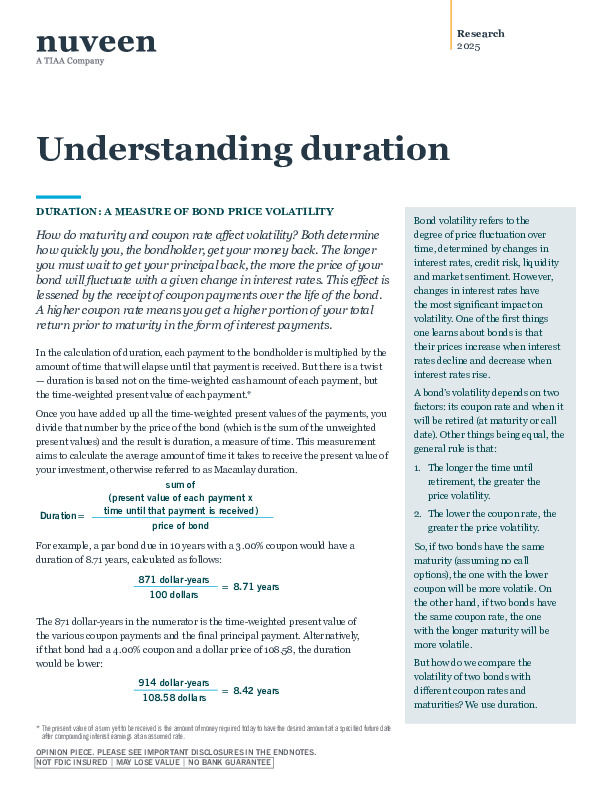

Key volatility driver: Duration captures how a bond’s price responds to rate changes—longer durations mean greater sensitivity.

-

Strategic relevance: Modified and option-adjusted duration help assess pricing scenarios, especially with callable or premium bonds.

-

Portfolio application: Duration targeting allows managers to fine-tune risk exposure while balancing income, price stability, and return potential.

For a deeper understanding of how to apply duration analysis in today’s bond market, consider how these concepts integrate with your current strategy.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.