Over the past decade, government initiatives have significantly curbed international tax evasion. However, the real impact of these measures remains a subject of debate. A new report now calls for a global minimum tax for the world’s ultra-rich.

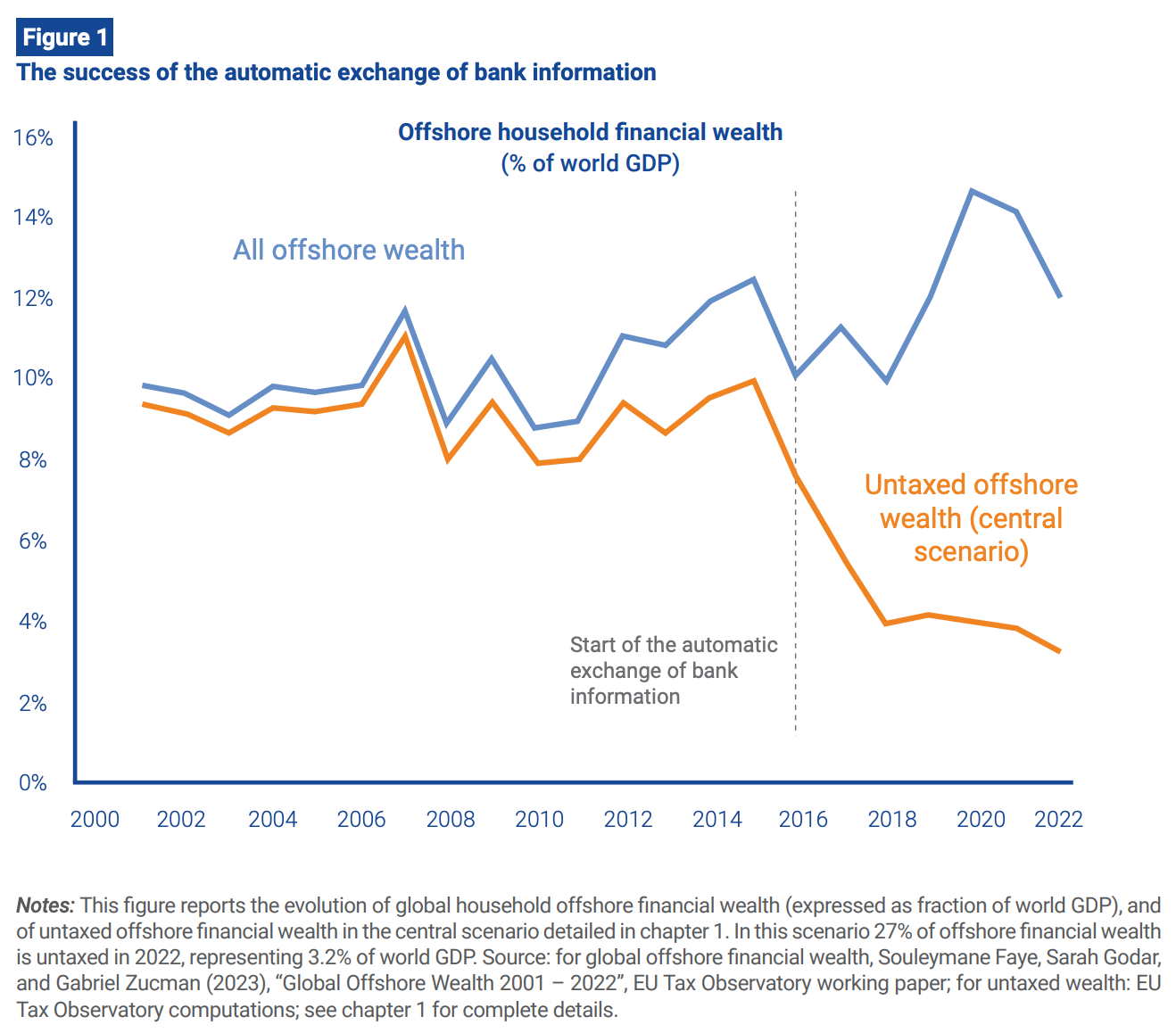

"The Global Tax Evasion Report 2024" reveals a major decline in offshore tax evasion, backed by collaborations from over a hundred international researchers. Released this week by the EU Tax Observatory at the Paris School of Economics, the study raises concerns over domestic discrepancies and diminishing global tax measures. Benefiting from the automatic exchange of bank information, offshore evasion has nosedived, affirming the impact of policy bolstered by political determination.

Nearly enough to address the climate challenge

The research calls for a thorough review of international tax strategies to promote fairness and suppress tactics that further inequality. Among the recommended solutions, a global minimum tax on billionaires, amounting to two percent of their wealth, stands out. Preliminary estimates suggest this could generate nearly 250 billion dollars annually from fewer than 3,000 individuals. A strengthened global minimum tax on multinational companies, free of loopholes, would raise an additional 250 billion dollars per year. Combined, these sums could significantly address the 500 billion dollars in public finance needed to address the climate change challenge, the report said.

“It is time to establish a global minimum tax on the very rich, something this report calls for,” said Nobel Prize-winning economist Joseph Stiglitz, also an advocate for international corporate tax reforms. “This may seem impossible to attain, but so was undermining bank secrecy and introducing a minimum tax on corporations just a few years ago.”

Policy success

Holding companies

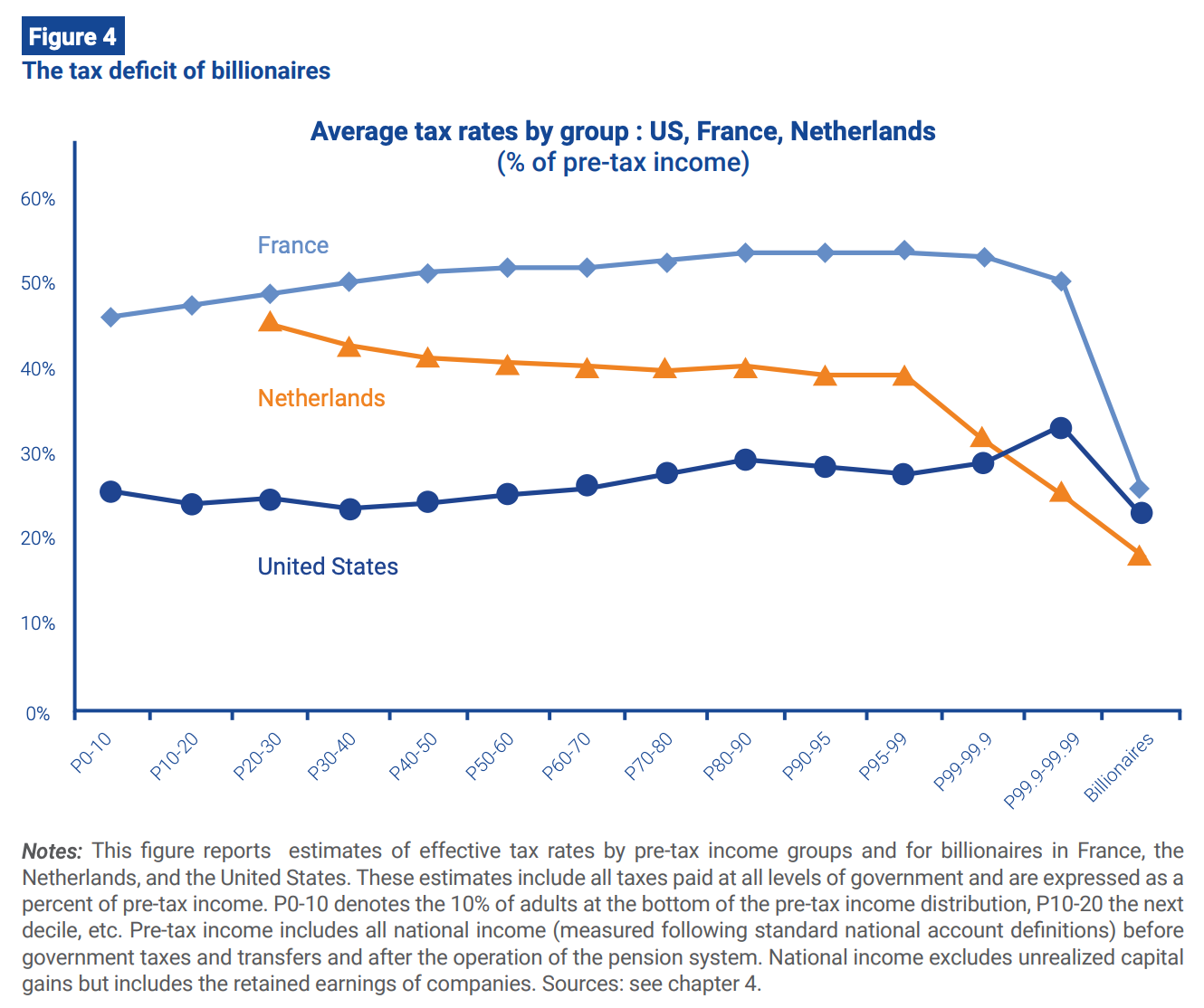

Particularly noteworthy is the Netherlands, ranked alongside France and the US as a preferred domain for billionaires. "A key reason why billionaires tend to have low effective tax rates is that in many (though not all) countries they can use personal wealth-holding companies to avoid the income tax," the report said.

Multinational companies, meanwhile, shift hefty profits to both the Netherlands and Ireland – each attracting over 140 billion dollars in recent years. Luxembourg, often referenced in the report, is the fifth-largest beneficiary of profit shifting, trailing the Netherlands, Ireland, Switzerland, and the British Virgin Islands.

Real estate opportunities

Stiglitz, in his foreword, lauds the report’s comprehensive analysis of global tax evasion and competition progress.

“One key lesson is that progress can be made if the policy response is correctly tailored. The advent of the automatic exchange of bank information—which has curtailed bank secrecy globally—has led to a reduction of offshore tax evasion by a factor of three,” Stiglitz said. “But the report also points out that other international efforts are falling short of their initial ambition. Real estate continues to provide ample opportunities for the rich to avoid and evade taxes.”

Optimism regarding a global minimum tax for multinationals, originally set at 20 percent, is waning. Although initially projected to boost global corporate tax incomes by almost 10 percent, a growing loophole network has slashed this prediction in half. Put into perspective against a fixed 20 percent minimum tax, expected returns have dwindled threefold, the reports’ authors have calculated.

Shift from offshore to domestic

Domestic arenas are becoming the latest epicentres for tax evasion. Shell companies, now increasingly used by global billionaires, lead to negligible effective tax rates, sometimes barely half a percent. This overlooked trend poses a grave threat to public confidence in contemporary tax systems, warn the report's authors.

Income taxation for expats has become another battle field among countries. In the Netherlands, some 92,000 expats enjoy a lower tax rate than Dutch employees because of a 30 percent income tax discount for five years. This makes the Netherlands relatively attractive for the companies that seek to employ an international workforce.

![]() Luxembourg has a similar expat regime and is among 10 EU countries that offers preferential taxation of global or foreign income. Italy and Portugal, meanwhile, have a special pension income tax regime for foreigners designed to attract wealthy pensioners.

Luxembourg has a similar expat regime and is among 10 EU countries that offers preferential taxation of global or foreign income. Italy and Portugal, meanwhile, have a special pension income tax regime for foreigners designed to attract wealthy pensioners.

30 income tax regimes in EU

Within the EU, there are now a total of 30 different national income tax regimes that help some 260,000 people save an average of 28,392 euros per year in taxes. The fiscal cost of these regimes amounts to some 7.6 billion euros per year.

The report stresses that tax evasion is not inevitable but a product of policy decisions. International cooperation can tip the scales – either facilitating rampant tax evasion or promoting efforts to suppress it. Ambitious global pacts can fast-track change, but even individual actions can wield substantial influence. However, the study does acknowledge its data constraints, underscoring the importance of enhancing public statistics. This includes more detailed data on corporate profits and effective tax rates across varying socio-economic groups. Nonetheless, clear trends emerge, such as the triumph of automatic information exchanges and consistent profit migrations to tax shelters.

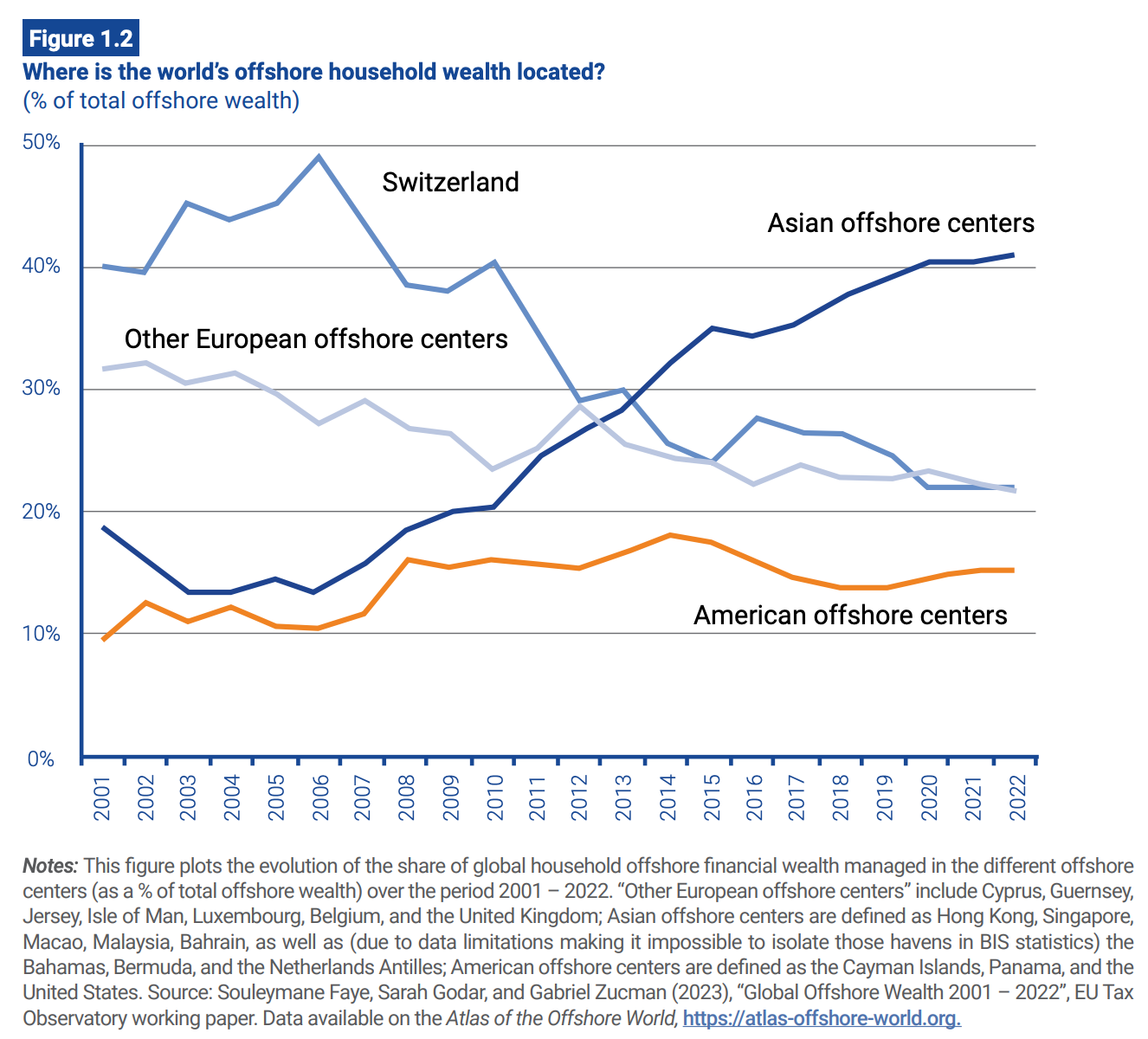

Where is the world's offshore wealth?