By Mathieu L’Hoir, Multi-Asset Manager at AXA IM

Following a spectacular 2019, we enter 2020 with cautious optimism

Despite a backdrop of concern over the threat of a potential recession, 2019 was a stellar year for equity markets - and bond markets to a certain degree. We now enter 2020 optimistic – albeit with caution and a bias towards equities.

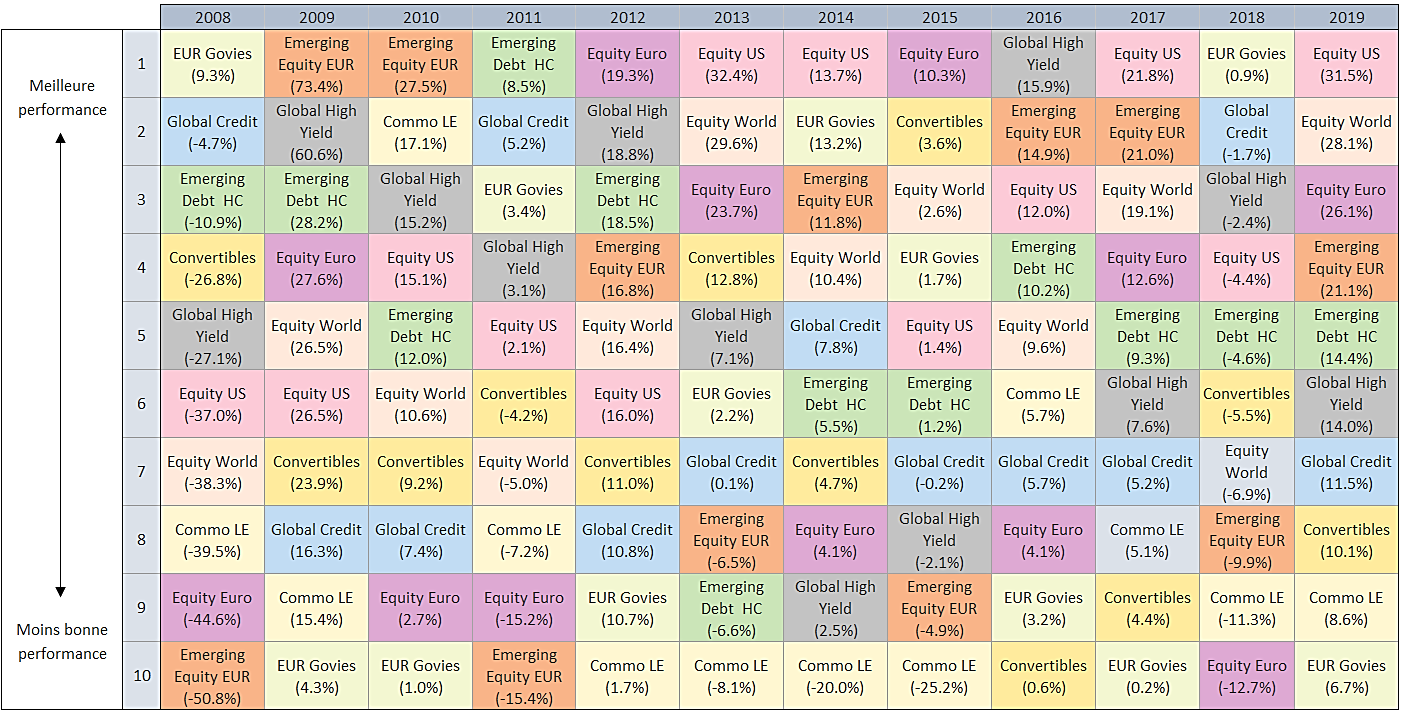

But diversification remains vital, as the chart below highlights, asset classes tend to perform haphazardly - the same asset class, or region, is unlikely to come out on top every year.

Source: AXA IM; 31/12/2019

During 2019, US and European equities continued to be supported by greater financial leniency from the Federal Reserve and European Central Bank. Technology stocks, a dominant part of the S&P 500, helped drive the index +31.5% higher last year, outperforming the Euro Stoxx 50, which comprises fewer tech assets.

Despite a worthy performance in 2019 (+21.1%), emerging market equities suffered from the strong US dollar, which hurt their borrowing costs. But equally the slowdown engulfing South America, China and even Turkey - as well as economic, social and political tensions, all had an impact.

Commodities (+8.6%) performed moderately well, especially industrial metals, though this was held back by slower growth in China, the world's leading consumer of copper. Chinese industry has also had to absorb overcapacity from previous years.

2020 looks set to be a potentially moderate year but we are optimistic about several asset classes:

1. European equities

- Investors abandoned European stocks in 2018-2019, as shown by inflow figures for exchange-traded funds and mutual funds. But we believe the latter should benefit from renewed interest

- We believe we are due a cyclical recovery, despite the expected relatively limited impact from the coronavirus. Therefore, we are increasing our exposure to cyclical stocks such as energy - a sector in which we have taken tactical positions

- Valuations remain relatively attractive compared to the rest of the market

2. Inflation-linked bonds

- Inflation is rising in several regions, especially Europe

- We believe the inflation forecasts as implied by market prices are too low

3. Commodities

- Following the coronavirus outbreak, the oil price has moved sharply lower and is currently sitting far from its medium-term equilibrium price

- Industrial metals have also fallen of a cliff, but we expect better news on global manufacturing later this year which should support demand

The asset classes we believe to have the least potential in 2020

1. US and European government bonds

- We believe central banks are unlikely to be taking their quantitative easing programmes any further, despite the unlikelihood of normalising their monetary policies

- Historically low interest rates means holding these assets is not a very attractive option

2. US and European credit

- Credit spreads are extremely tight, and the probability of them narrowing further is low

- US corporate debt is high

- The coupon you get from holding credit is very low, given the low level of corporate bond yields.

Our 2020 investment approach

In 2020, we will be keeping a particularly close eye on the US Presidential Election, the coronavirus, Chinese debt, US corporate debt, Brexit, and how the trade war plays out, among other geopolitical risks.

We believe that themes such as online payments, cybersecurity, the Internet of Things and robotics will continue to be attractive and that their valuations won’t restrict further growth. Companies to watch* include Check Point Software and Palo Alto for cybersecurity, Pagseguros for payment methods in Brazil, and MasterCard, which is also one of our positions. We also like MedTech companies, especially ones in Asia like Becton Dickinson, which is one of the main positions in our global flexible multi-asset strategy.

We will naturally adopt a proactive and reactive approach to our allocations, in line with our convictions. Faced with several different scenarios, we aim to demonstrate flexibility and will seek to detect market signals in order to determine our tactics and make our moves.

*These companies are named as an illustration only and do not constitute investment advice or a recommendation from AXA IM.