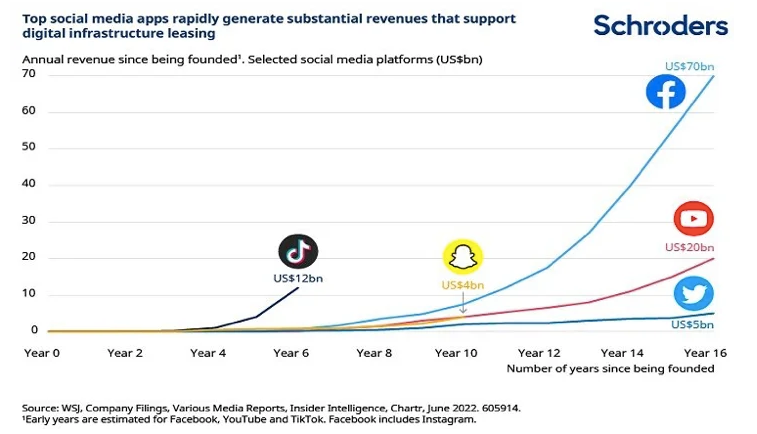

Just six years after its launch in 2016, short-form video app Tik-Tok has been downloaded more than 3 billion times.

The company’s explosive growth was accelerated by a lack of physical interactions during the Covid-19 pandemic, but its popularity continues to gather momentum, with more than 1 billion videos viewed on the platform every day by its 700 million active users.

A parallel trend is transforming business operations around the world.

1. Digital infrastructure enables new forms of communication to grow rapidly

With staff unable to visit offices and disaster recovery sites during lockdowns, businesses also went digital, embracing cloud computing and video conferencing.

Downloads of the Microsoft Teams video platform increased more than 10-fold. Collectively, the largest US cloud computing providers (Amazon, Google, Microsoft, IBM and Oracle), spent nearly $50 billion on cloud capital expenditure during 2021, to keep up with the step-change in demand.

Facebook, reinvented itself as Meta and committed to spend more than $10 billion per annum to build out the Metaverse, requiring vast amounts of data centre space.

Google's DeepMind division said earlier this year that they were on the verge of achieving human-level AI (Artificial General Intelligence) through their Gato AI tool. AI tools deal with billions of parameters: the more computing power available, the more accurate they become.

Scale and speed-to-market are critical for these tech giants, which has created a huge leasing opportunity for the data centre industry where the key ingredients of land, power supply and fibre connectivity are increasingly tightly held resources.

“The cloud” is housed in gigantic fortress-like warehouses, filled with hundreds of thousands of computer servers. To guarantee continuity, population centres are served by multiple cloud “availability zones”, each with multiple back-up power sources.

The infrastructure network serving Microsoft’s Azure cloud includes data centres, fibre optic cable and satellite communications. The company is planning new centres in Switzerland, Finland and India.

2. Cloud outsourcing is still in early stages

We believe that the digital transformation trend is only just starting, creating a long runway of growth for data centre operators.

Today, 95% of organisations are implementing a digital-first strategy with IT at the core of decision making. However according to IDC, 56% of data centre capacity remained on-site in legacy enterprise data centres at the end of 2020.

Outsourcing these computer workloads to third party shared (co-location) facilities offers companies greater business resiliency, project scalability and cost efficiencies.

Forecasters estimate co-location leasing growth of 7-13% per year depending on region, with hyperscale cloud facilities growing at more than 22% per year from 2020-2025. In aggregate this will require $1.3 trillion of capital expenditure over the period.

3. Faster 5G mobile networks are set to unlock exponential growth in data traffic

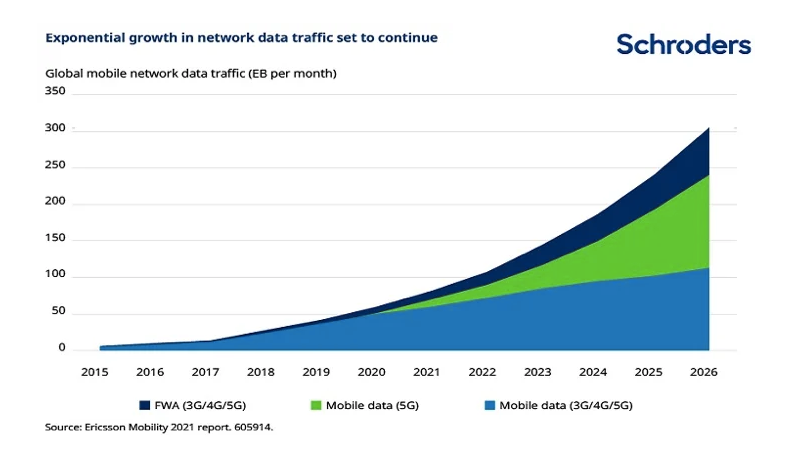

Since 2010 the number of internet users globally has more than doubled to nearly 5 billion, whilst the amount of internet traffic has grown by more than 150 times. A big part of this growth has been through mobile data services, following the release of the first iPhone in 2007.

Forecasters suggest that this exponential growth of data will continue. The introduction of Fifth Generation (5G) wireless communication is anticipated to drive a surge in mobile data traffic from 2020 to 2025.

5G’s shorter wavelengths can transmit data at up to 10 gigabits per second, which is up to 100 times faster than 4G. Although this is essential for future uses such as driverless cars, the downside is that these signals travel shorter distances and cannot penetrate objects as easily, requiring much denser network coverage.

Mobile Network Operators (MNOs) are now racing to lease more macro towers, fibre optic cable and small cell antennas to provide this denser coverage.

Forecasters expect $1.1 trillion of mobile capital expenditure in the period 2020-2025.

(Please note: EB per month in the chart above refers to exabytes. This is a large unit of computer data storage; equivalent to one billion gigabytes.)

4. Digital infrastructure assets well placed to weather economic volatility

Digital infrastructure is now considered to be “mission critical” by consumers, governments and corporates. Total industry capital expenditure in the period to 2035 is expected to exceed water infrastructure, railroads and airports.

We expect digital infrastructure customer demand to be relatively immune to economic shocks. This is evidenced by reviewing the rental revenue of Crown Castle through previous recessions (see chart below). Its cash flows are backed by investment grade tenants such as AT&T and Verizon.

The US government has assigned $65 billion of their $1.2 trillion Infrastructure Investment and Jobs Act towards closing the digital divide in unserved and underserved US communities. This is likely to result in a significant rollout of fibre capacity over the next decade, regardless of economic conditions.

Digital infrastructure owners structure their leases to protect against external shocks such as inflation and currency devaluation. In the case of macro towers, this can mean explicit linking to the local consumer price indices, fuel prices or simply a fixed annual rental uplift of 3%. With supply chain resources becoming tighter, digital infrastructure developers are increasing their rental pricing.

5. Emerging markets’ explosive growth offers potential as countries build digital infrastructure

Over the next decade we expect the most rapid digital infrastructure growth to come from emerging markets. These countries are the most under-served currently, yet have youthful populations with an insatiable demand for connectivity and content-sharing.

Internet users have skipped slower generations of broadband and mobile technology and are just beginning to gain access to superfast fibre to the home and 4G/5G phone signals, unlocking massive economic potential.

We see opportunities across the core subsectors of data centres, macro towers and fibre optic cable, as the digital economies of emerging markets bloom over the next decade and beyond.

The US and Chinese tech giants are rapidly moving into these markets. Microsoft said in March that it plans to provide cloud services in Hyderabad, India, adding to its bases in Pune, Mumbai and Chennai. However, a lack of digital infrastructure in place is requiring them to either develop facilities or lease them from third parties such as Sify Technologies, which has facilities in the city.

According to Cisco, internet penetration in India has risen from 27% in 2017 (357 million people) to 60% in 2022 (840 million people), meaning it now has the second largest internet user base in the world after China (1 billion people) and nearly three times that in the US (300 million people). Yet India has only 1/20th of the number of data centres present in the US according to CloudScene.

As India's population reaches 1.5 billion and internet penetration climbs, the infrastructure shortfall will widen without significant investment.