Pricing pressure is rising: what does this mean for equities and other assets, and should we be worried? For investors focused on value, it could be good news.

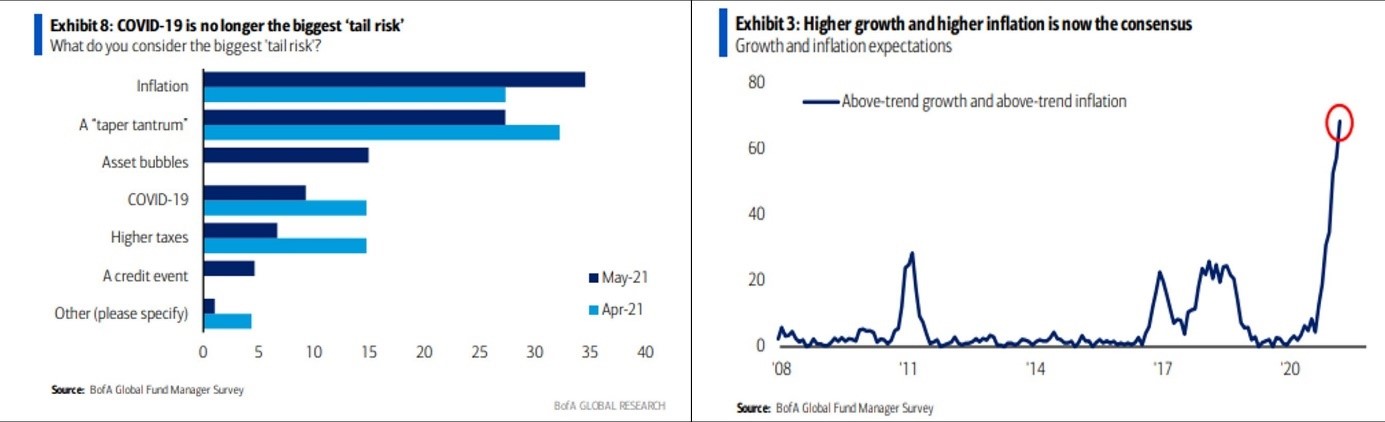

After a year of anxiety about COVID and its economic damage, investors now have something bigger to worry about. At least that's the picture painted by Bank of America's Global Fund Manager Survey, the latest of which shows that inflation is now seen as the largest tail risk to asset prices with expectations for a surge in growth and prices at their highest since the poll started in 2008:

NB: Shaded periods illustrate USD strengthening as measured by the DXY index.

It's not only fund managers who are worried. Google searches for inflation have more than doubled over the last twelve months and are up by a third since the start of May[1]. Pessimistic media headlines and speculation have contributed, but rising prices are also starting to be felt in peoples' pockets. The Organization for Economic Co-operation and Development Consumer Price Index (OECD CPI) rose 2.4% year-on-year in the latest March figures, up from 1.7% a month earlier[2].

Base effects

Much of the rise in CPI has been driven by higher energy prices – up 7.4% on average for the 37 OECD countries but as much as 34.1% in Norway. The cost of other commodities has also skyrocketed as economic activity picks-up, particularly materials used in construction (e.g. timber, steel, copper aluminum) and manufacturing (e.g. lithium, cobalt). The Bloomberg Commodity Index shows that prices are over 50% higher than a year ago – albeit from a very low base at the height of the pandemic – indicating further inflationary pressure ahead as this feeds into goods and services.

What remains to be seen is whether inflation will be short-term, largely driven by strong demand pent-up during the pandemic while supply remains disrupted, or longer-term if prices lead to rising wages. There are signs of this already happening in countries like the US. Some economists are concerned that a continuation of these recent trends could see a return to the double-digit inflation levels of the 1970's, when high oil prices, unemployment and slow growth combined to cause crippling stagflation for economies around the world.

The introduction by many countries of inflation targeting during the 90's and 00's in response to previous policy failures has kept inflation largely subdued in recent years, but with prices rising again, what could a return to long-term inflation mean for equities and other asset classes?

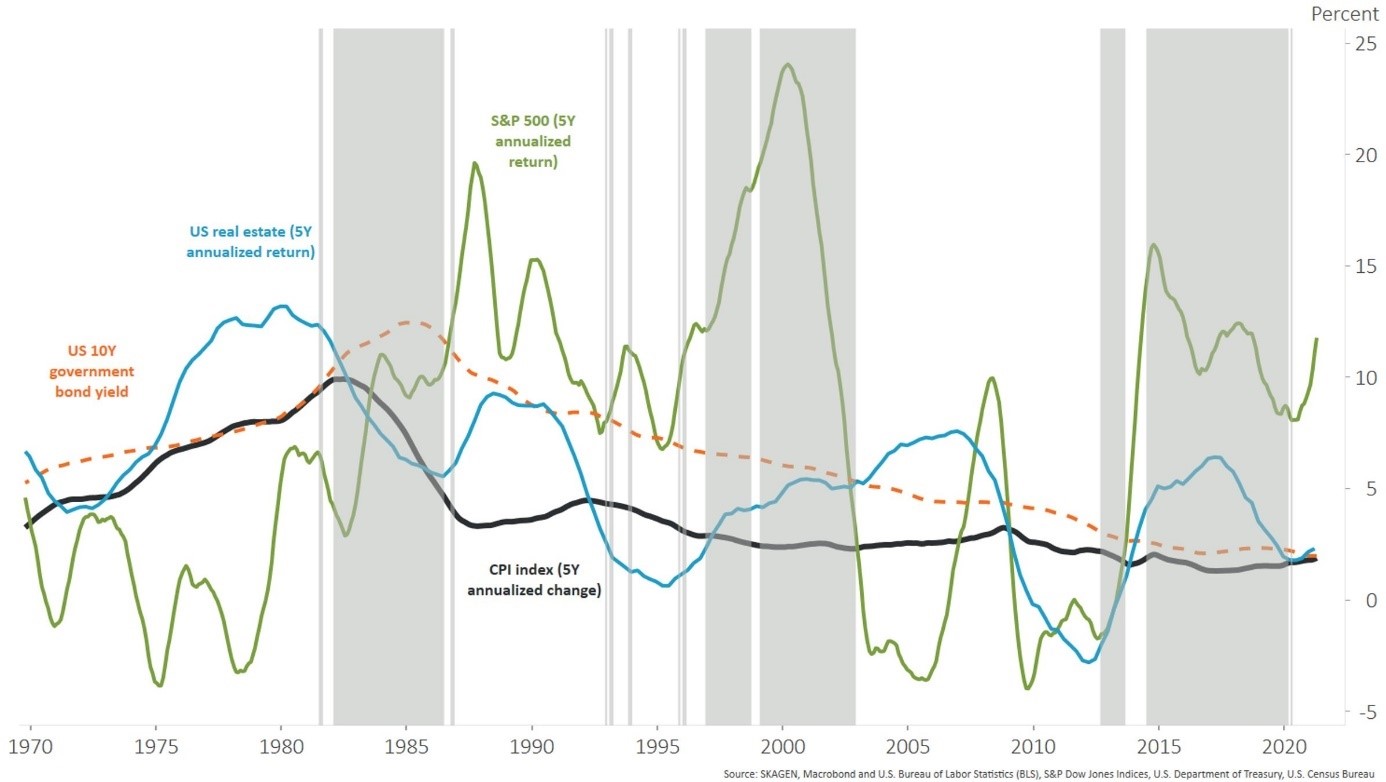

A brief history lesson of the past 50 years, using the US for illustration, shows that equities have generally been negatively correlated with rising prices. Stocks were weak (although not necessarily negative) in previous inflationary periods such as the 70's, late 80's and early 00's, but performed strongly during disinflationary times (early 80's, 90's and GFC to date). Currencies also tend to weaken in an inflationary environment and strengthen when there is disinflation. On the other hand, Interest rates and bond yields move in line with inflation, while real estate has historically done the same and lived up to its name as a hedge against rising prices.

Bond yields and real estate typically move in synch with inflation while stocks and currencies are negatively correlated

NB: Shaded periods illustrate USD strengthening as measured by the DXY index.

Opinions divided

This is clearly a simplistic summary which neglects a lot of economic, regulatory and political detail but it is useful to put where we are today in a historic context as we consider what might happen next. Economists are unsurprisingly split over whether current price rises are temporary or the start of a longer-term inflationary trend.

So-called hawks believe that central banks have provided too much stimulus and with low interest rates offering little incentive to save, growing demand for goods and services will inevitably drive inflation higher. Inflation 'doves' disagree, arguing that the world is very different from previous cycles as the global economy is more integrated while high unemployment and weaker trade unions mean it is unlikely workers will be able to push for pay rises even if prices continue to rise. With world output forecast to rise by 6.0% this year and 4.4% in 2022[3], supply bottlenecks are expected to be overcome and strong economic growth should mean we avoid stagflation.

The OECD forecast that inflation will peak in Q1, fall in Q2 and then rise gently from the second half of the year[4]. This view is supported by the IMF which anticipates that pricing pressure will remain contained in its World Economic Outlook published in April[5]: "The volatility should be short lived. Baseline projections show a return of inflation to its long-term average as the remaining slack subsides only gradually and commodity-driven base effects fade away."

While there is undoubtedly some slack in the economy, it can be eaten away quickly and then we may well enter a longer-term inflationary investment cycle. The yield on 10-year US government bonds has climbed from 0.9% to 1.6% this year[6] which could indicate that investors expect an acceleration of monetary policy tightening to combat rising prices, despite statements from the Federal Reserve that they believe inflation to be temporary.

For investors focused on value like SKAGEN, expectations of higher inflation could be good news. It would likely quicken the rotation to value stocks providing near-term earnings from growth companies promising more distant cash flows. There are other reasons why value tends to outperform during inflationary periods, which I will explore in a future update.

For more articles on SKAGEN Funds and our range of value funds, please visit www.skagenfunds.com or contact me at

e-mail: michel.ommeganck@skagenfunds.com

Mobile phone: +4790598412

[1] Source: Google [2] Source: OECD Inflation (CPI), 24 May 2021 [3] Source: IMF, World Economic Outlook, April 2021 [4] Source: OECD Inflation forecast, 24 May 2021 [5] Source: IMF, World Economic Outlook, April 2021 [6] Source: CNBC, 24 May 2021