The surprisingly strong global growth recovery is shifting to a lower gear, says Evan Brown, Head Mulit Asset Strategy at UBS Asset Management in his latest Macro Quarterly. "The timeline for a reliable vaccine and changes in monetary stimulus could both accelerate and jeopardise this recovery.”

Highlights from the report:

- The outlook for US and global growth remains positive even in the absence of additional fiscal support.

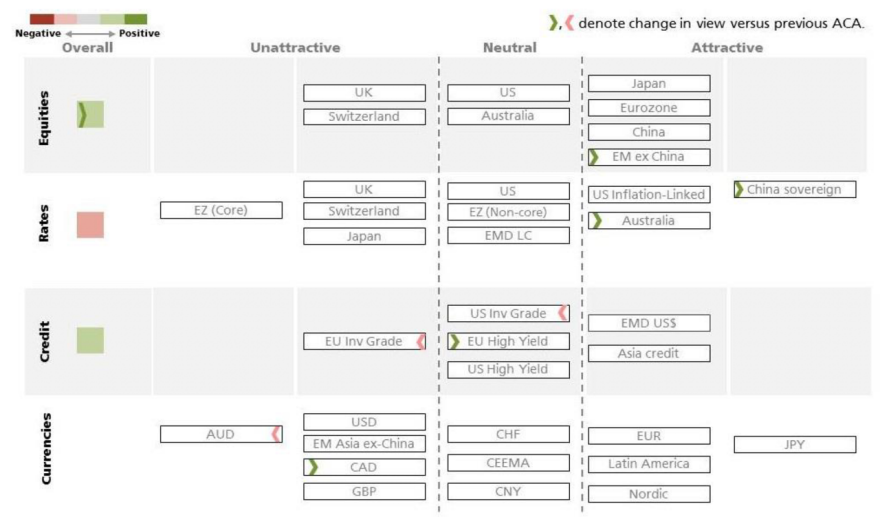

- We favor cyclical, value, and emerging market exposures on increased confidence in the durability and broadening of the early-cycle environment.

- Investors should focus on the totality of policy changes in assessing US election outcomes, not merely the tax implications.

According to Brown, the recent market correction was a good time to tactically add more risk to portfolios by including economically more sensitive sectors and regions. “We see a suite of attractive relative value opportunities across asset classes, with a preference for trades consistent with a broadening of risk appetite on enhanced investor conviction in the process of durable economic normalization.”

The end of tech-dominance

The announcement of a vaccine approval will help spark rotation within equities, reversing a regime dominated by exceptional gains for the few – mega-cap tech firms – relative to the many, particularly cyclical and value stocks, says Brown.

“Within US equities, the fundamental tide is turning in favor of broader equity exposure compared to the tech-heavy Nasdaq 100. A vaccine announcement is likely to reinforce this trend by increasing visibility into the earnings recovery outside of technology and other work-from-home beneficiaries. In addition, it should also catalyze the next phase of US dollar weakness in which undervalued, higher-beta emerging market currencies meaningfully outperform.”

US presidential elections

According to Brown, the upcoming presidential and congressional elections in the US could implicate the redefinition of fiscal policy.

“A Blue Wave could lead to a substantial green infrastructure push and tax increases. Retaining the status quo of a Trump presidency and divided Congress would likely see the continuation of deregulatory policies and trade disputes. A Biden win and split Congress could mitigate fears of higher taxes but also result in a fiscal impasse that weighs on the nascent US expansion in 2021 and beyond. Polling data and prediction markets suggest the most likely outcomes are relatively positive for international equities and negative for the US dollar, which would offer an additional tailwind for many of our preferred positions.”

Bernie Sanders

Browns’ conviction is that continued fiscal stimulus is necessary to ensure a vigorous economic recovery. “As such, we caution against narrowly focusing on the higher taxes that would likely accompany a Blue Wave and failing to appreciate the offset that would be provided by presumed significantly higher spending. The net result would not be a material and prolonged negative for the entire universe of US assets, particularly the more cyclically-oriented. Investors often err in presumptions about whether a certain politician or set of policies has positive or negative market implications. For instance, the most powerful measure in the CARES Act that supported the outlook for consumer spending, and in turn, US stocks, was enhanced unemployment benefits. The politician that insisted on this measure is the same one that investors feared would be the most market-unfriendly potential president: Vermont Senator Bernie Sanders.”