Jade Fu, portfolio manager at UBS Asset Management, sees a multi-asset approach to investing in China as an optimal way to capitalize from new policy catalysts—while staying diversified and protected against downside risk.

Headwinds to tailwinds

2023 is a year in which we expect China will reassert itself as the engine of global economic activity. Chinese policy has evolved in a much more growth and market-friendly direction. As the zero COVID policy ended, we are confident that a comprehensive, durable economic reopening with staying power has started, underpinning the return of consumer spending to pre-pandemic norms.

In addition, prior attempts to rein in excesses in real estate are being replaced with a more nuanced set of measures designed to support both supply and demand and promote stability in the overall sector. And the regulatory campaign on Chinese technology and internet platform companies appears to have run its course. A more cooperative relationship with the government for these companies makes a critical catalyst for equity multiples to re-rate higher, in our view.

A wide range of opportunities

We believe a multi-asset approach to investing in China is optimal because it gives investors comprehensive exposure to this multifaceted suite of policy changes.

Onshore equities are heavily weighted towards domestic financial and industrial companies, which are well-positioned to benefit from a generally improving economy. The end of the technology regulatory campaign disproportionately helps larger internet platform companies, which are well-represented in offshore equity indexes, by removing a critical overhang on valuations.

Investors can also gain access to the prospective stabilization in real estate through Chinese high yield bonds. We are cognizant that Chinese developers face structural challenges. But investors are being well-compensated for assuming such risk, in our view, with spreads at levels rarely seen outside of times of crisis. We expect a controlled deleveraging in real estate going forward, given the importance of the sector to the economy and household net worth.

Meanwhile, Chinese sovereign bonds help insulate investors from any country-specific concerns that may weigh on domestic risk assets. Indeed, they demonstrated this capability recently, faring much better than US and European fixed income indexes during the period of Chinese risk asset underperformance that started in early 2021.

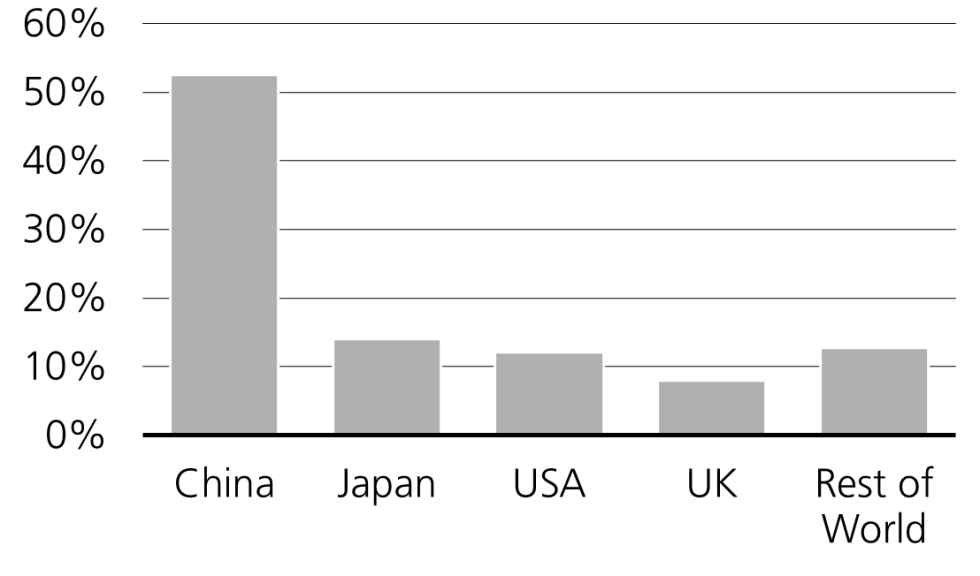

China’s demographic challenges, which are likely to contribute to a slower rate of economic growth over the medium term, are well-documented. What is less appreciated, in our view, is how much this dynamic is also boosting the demand for asset management services and flows into financial markets. We anticipate that financial assets will continue to gain share from real estate as a preferred savings vehicle within China in accordance with the mantra that “housing is for living, not for speculating,” Through mid-2022, the five-year average growth in assets under management in China has far outstripped that of other major countries, rising in excess of 50%.

Source: Morgan Stanley Research, EPFR as of March 2022.

Exhibit one gives the last five years growth in assets under management by market for China, Japan, USA, UK and the rest of the world, showing China has grown far more than any other region, at over 50%.

Here you will find the complete report from UBS Asset Management.