Ever since the European Securities and Markets Authority, Esma, published its final report on the draft regulatory technical standards, known as the RTS, on 19 December 2023, in particular the redemption policy, minimum holding period and mandatory liquidity management tools, or LMTs, of European Long-Term Investment Funds, or Eltifs, have been points of intense discussion.

On 8 March 2024, Esma received a letter from the European Commission in which it informed Esma that it intends to adopt the RTS with amendments and invited Esma to submit a new draft that would cater for the “individual characteristics of different Eltifs”. Esma responded to this in an opinion on 22 April 2024 with a substantially revised draft. This contribution sheds some light on a number of amendments contained in the Esma opinion with respect to, in particular, the minimum notice period, LMTs and redemption gates.

Minimum notice periods, redemption frequencies/gates & liquidity pockets

Esma took note that stakeholders, as well as the Commission, were not in favour of an approach under which a mandatory notice period would be set for all Eltifs, given, in particular, the variety of Eltif strategies and assets in which an Eltif may invest in.

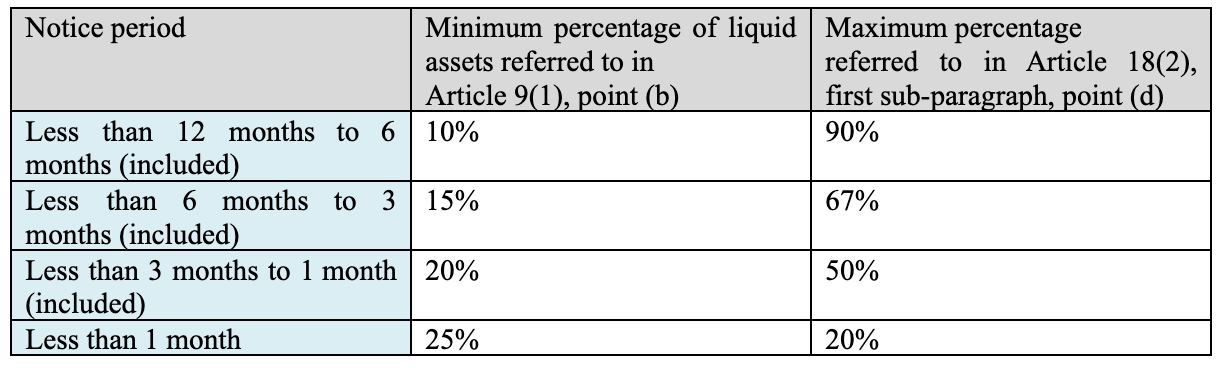

Considering this, Esma’s redraft reads as follows:

The proposal links the length of the notice periods to minimum percentages of liquidity pockets and maximum percentages of redemption gates. The table does not refer to the redemption frequency, as Esma is of the opinion that Eltif managers would not be able to stagger the sales of assets, if all redemption requests were formulated one day before the redemption day.

In addition, Esma proposes in its opinion that the need to justify the appropriateness of the notice period to the competent authority should be triggered if the notice period is less than six months, instead of three months.

LMTs & redemption gates

In relation to LMTs, the Commission considered in its letter that the RTS could be viewed as disincentivizing or limiting the possibility for Eltif managers to implement different LMTs that could be equally or even more compatible with the long-term investment strategy of the Eltif. Following this, Esma has amended its RTS draft in a way that anti-dilution LMTs are not yet anymore seen as the “default” for which a derogation request for the use of any other LMT would need to be made to a competent authority.

Instead, the new draft mentions that Eltif managers “may” select and implement, at least, on anti-dilution LMT. In addition, the new draft also mentions that also other LMTs “may” be selected, if appropriately justified to the competent authority.

Do the redrafted RTS meet industry standards?

From the above, it is clear that ESMA has made an effort to implement both the Commission, as well as the comments made by the industry in the redrafted RTS of its opinion.

In terms of open-ended Eltifs, Esma now suggests to calibrate the redemption policy of Eltifs, in the first place, on the length of the notice period that are then accompanied by a maximum threshold for redemption gates and a minimum threshold for liquidity pockets to be used. The maximum thresholds for the redemption gates do not pose any constraints in practice. Interestingly, the redemption frequency is also not limited by any maximum thresholds. Instead, a “comply-or-explain mechanism” is proposed to be introduced in which Eltif managers would need to justify the use of redemption frequencies that are less than quarterly to their respective competent authorities. A lot of flexibility is, thus, there in this respect.

Instead, practitioners mostly will pay attention to the length of the minimum notice period, as well as the related minimum liquidity pocket required by the RTS. Liquidity pockets intervene in the risk/return profile of an Eltif. Hence, it is important that the size is set neither too low nor to high. In this respect, notice periods of three months will be necessary to meet industry demands in terms of the size the liquidity pocket. In some instances, industry practitioners may see this as too long, but, in general, the table is considered to be reasonably workable by practitioners.

While the redrafted RTS meet a number of industry demands, it will be interesting to see what the final text will ultimately look like.

Marc Meyers is co-managing partner of Loyens & Loeff Luxembourg and heads its investment management practice Group. Sebastiaan Hooghiemstra is a senior associate in the investment management practice group of Loyens & Loeff Luxembourg and Senior Fellow/Guest Lecturer of the International Center for Financial Law & Governance at the Erasmus University Rotterdam. The law firm is a knowledge partner of Investment Officer.