By Jonathan Baltora, Head of Sovereign, Inflation and FX, Fixed Income, AXA IM

While the war in Ukraine has pushed many commodities prices higher, inflation was already about more than only food and oil, with core Inflation numbers at their highest point in decades in many advanced economies. We prefer short-term inflation-linked bonds and do not believe that tighter monetary policy is a major risk to this strategy.

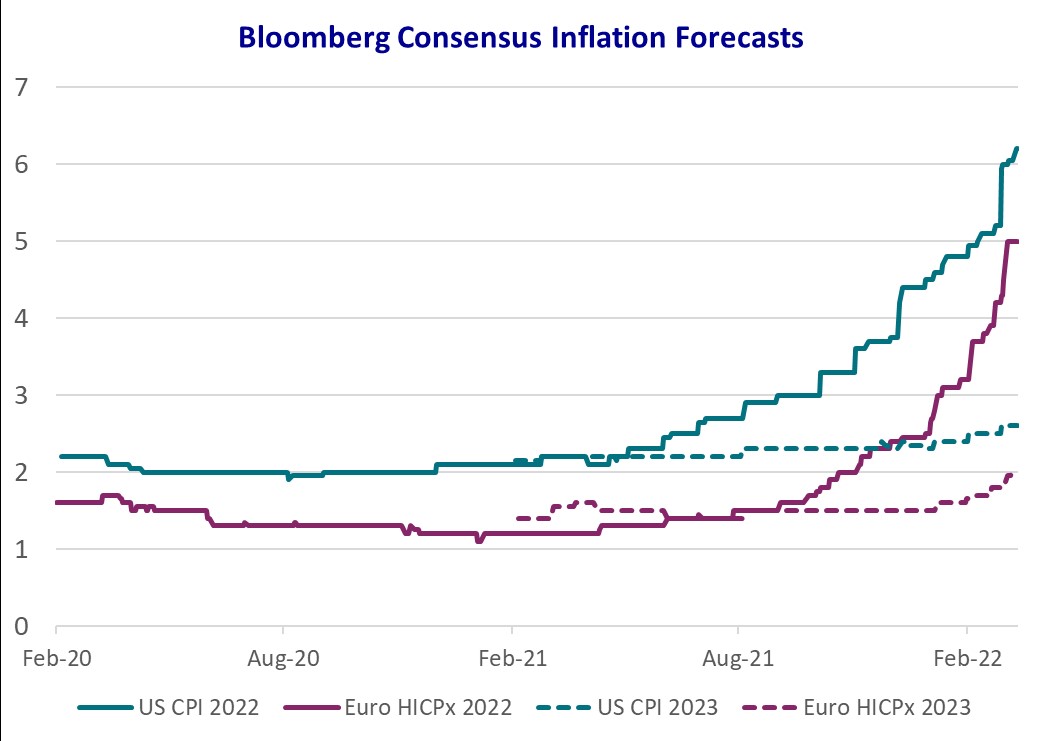

Inflation forecasts keep being revised higher and the timing for peak inflation keeps being pushed into the future.

While a year ago US inflation was expected to peak at 3.5% during summer 2021, today it is now expected to reach close to 9% before summer 2022. Inflation forecasts have been consistently pushed higher for this year, but the Bloomberg consensus of economists does continue to see inflation as transitory, as 2023 inflation forecasts are close to central banks’ targets.

Source: Bloomberg/ AXA IM

Source: Bloomberg/ AXA IM

Current inflation is hot because of COVID-19-related issues, and medium-term risks point to sticky inflation.

A large share of currently-elevated inflation is linked to COVID-19. Current lockdowns in China are potentially making it longer lasting than expected, but we see three key medium-term risks to the upside for inflation – and the war in Ukraine has only exacerbated those risks. First, structurally more elevated fiscal spending, not even accounting for bigger military budgets; second, trade wars and re-onshoring of production; and third, the green revolution or ‘greenflation’.

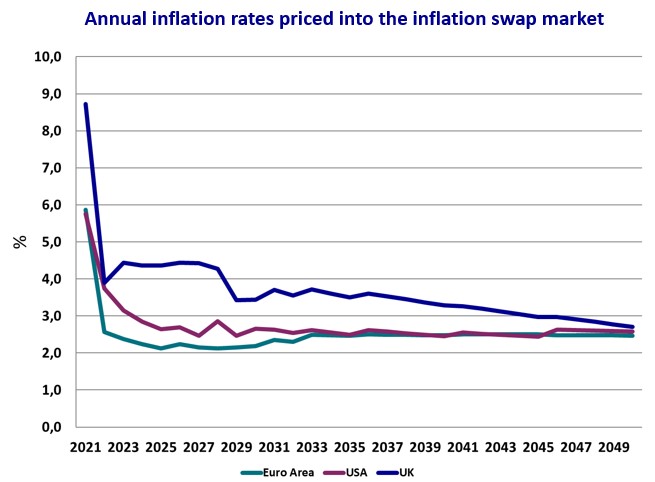

Despite the risk that inflation proves to be longer lasting and stickier than economists’ forecasts, the market is pricing in a sharp deceleration from 2023.

Source: Bloomberg/ AXA IM

While we are convinced that inflation will decelerate in the second half of 2022, we see a risk that the slowdown may not be as abrupt as the market is expecting. Inflation swaps are currently expecting US and Eurozone inflation to be back to the central banks’ targets from late 2023. We see this as an optimistic pricing unless the economy enters a recession.

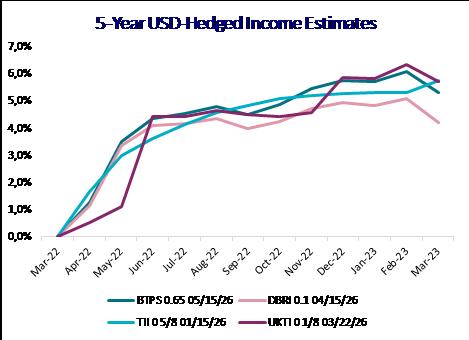

The currently extremely elevated monthly inflation numbers should be translated into solid income for inflation linked bonds. For this reason, we prefer short-term linkers aiming to capture generous carry while limiting duration exposure.

Source: Bloomberg/ AXA IM

We do not believe that monetary policy normalisation is a major headwind at this stage as income should be large enough to offset the potential negative price impact. We keep a close eye on oil prices that in the event of a significant fall may push inflation and income lower.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2022 AXA Investment Managers. All rights reserved