Asset Allocation Outlook

This asset allocation outlook from Van Lanschot Kempen, led by Joost van Leenders, provides insights into current market dynamics and tactical adjustments for portfolio strategy.

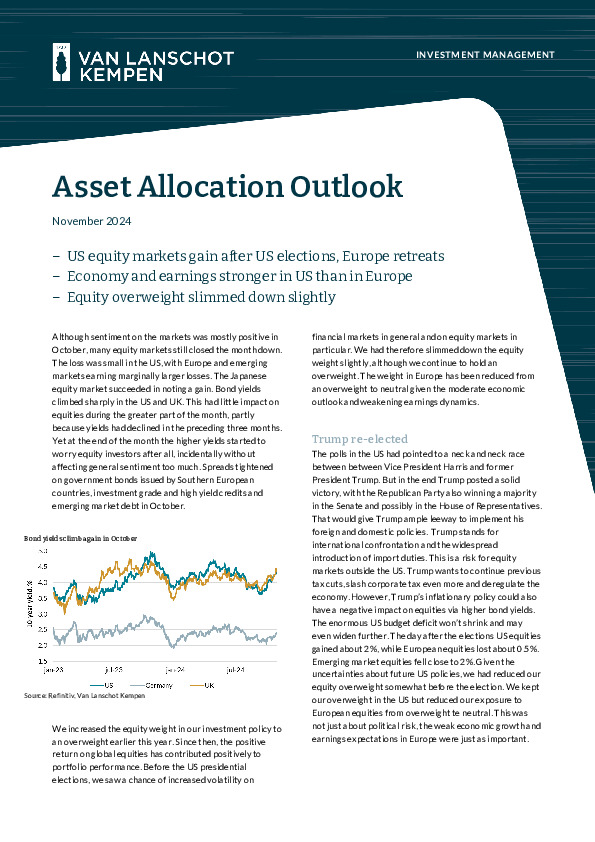

• Equity Positioning: Overweight in U.S. equities is maintained due to robust earnings growth, while European exposure is reduced to neutral amid weaker growth and earnings dynamics.

• Fixed Income: Cautious on high-yield and investment-grade credits as spreads remain tight; U.S. government bonds are preferred.

• Commodities and Real Estate: Neutral stance, with limited upside due to weak global industrial demand and high refinancing costs for real estate.

For a detailed breakdown of asset class performance and strategic recommendations, access the full report.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.