Weekly Market Update

The State Street Weekly provides a detailed analysis of the economic and market trends influencing asset allocation strategies for 2025.

Key Insights:

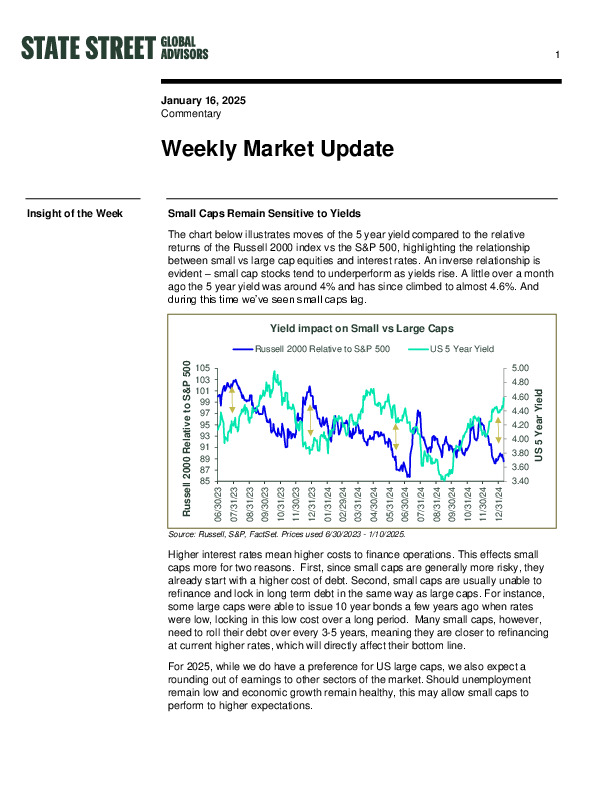

• Small Caps vs. Yields: Rising 5-year U.S. Treasury yields to 4.6% have pressured small caps, which are more sensitive to financing costs than large caps.

• Stock-Bond Correlation: The traditional negative correlation shows signs of normalization, though markets remain reactive to macroeconomic data.

• Portfolio Trends: The 60/40 portfolio gained 13.43% in 2024, supported by equity resilience and stable credit spreads.

• Sector Outlook: U.S. equities remain favored, with credit spreads signaling a stable macro backdrop.

For comprehensive insights and strategic recommendations, access the full report.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.