Big policy shifts reinforce higher rates

This week's BlackRock Investment Institute commentary provides a deep dive into major policy shifts impacting global markets and investment strategy. Key insights include:

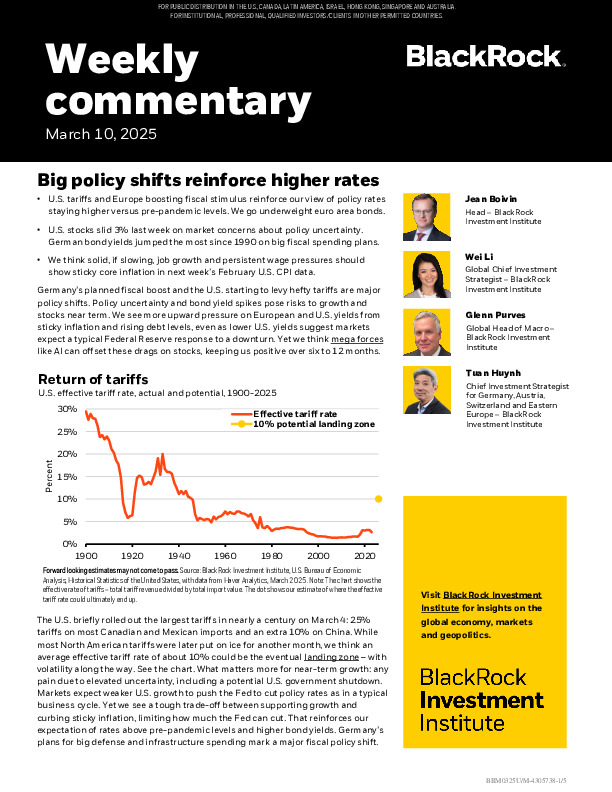

- Higher-for-Longer Rates: U.S. tariffs and Europe’s fiscal expansion reinforce expectations of persistently elevated interest rates and bond yields.

- Market Reactions: U.S. equities fell 3% amid policy uncertainty, while German bond yields surged the most since 1990.

- Inflation & Growth: Strong labor markets suggest core U.S. inflation remains sticky, limiting potential Fed rate cuts.

For a full analysis, read the report.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.