A Week Of Whiplash

In this week’s edition, Northern Trust’s Global Economic Research team assesses the intensifying global tariff tensions and their implications for markets, trade policy, and economic strategy.

Key Insights:

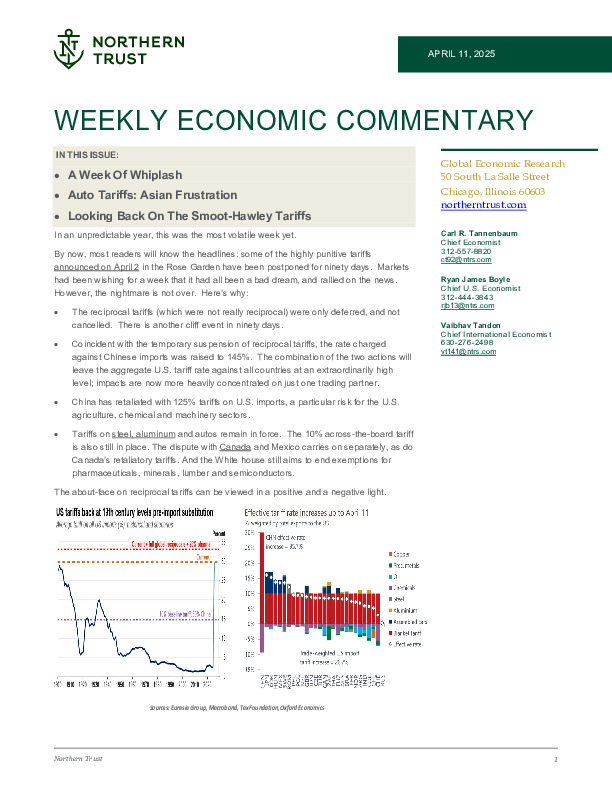

- Tariff Volatility: Some U.S. tariffs were postponed for 90 days, but 145% tariffs on Chinese goods remain in force; China responded with 125% tariffs, escalating trade risk.

- Automotive Focus: New 25% U.S. auto tariffs target foreign manufacturers, especially from Japan and Korea, threatening global supply chains and consumer pricing.

- Historical Warning: Today’s trade war echoes the Smoot-Hawley Act, which exacerbated the Great Depression—now raising fears of a modern repeat.

Explore the full report to understand how shifting tariff regimes could reshape strategic asset allocation and cross-border business decisions.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.