Targeting Alpha in a Fractured Trade World: Rethinking Global Equity Allocation

In this strategic outlook, Robeco’s Fundamental Equities team analyzes the implications of the new U.S. trade regime and outlines high-conviction global equity opportunities amid shifting geopolitical and macroeconomic dynamics.

Key Insights:

-

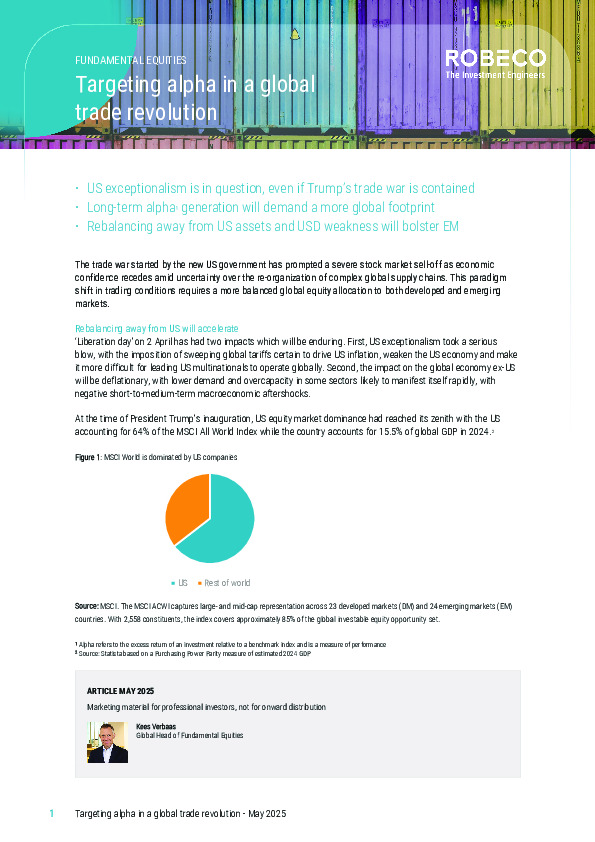

US Exceptionalism Fades: Tariffs, inflation, and geopolitical tension are driving capital away from U.S. equities and the dollar.

-

Valuation Gaps Widen: CAPE ratios highlight opportunities in emerging and non-U.S. developed markets.

-

EM Tailwinds: A weaker USD historically boosts emerging market equities; regional trade deals add momentum.

Discover Robeco’s actionable strategies for alpha generation in a redefined global equity landscape, access the full report.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.