Debt Dilemma: What the US Downgrade Means for Investors

State Street Global Advisors delivers a sharp commentary on the implications of rising U.S. debt levels and the recent Moody’s downgrade, assessing its muted market response and the broader consequences for asset allocation strategies.

-

Moody’s downgraded U.S. debt to Aa1, echoing earlier moves by S&P and Fitch—yet markets showed minimal reaction.

-

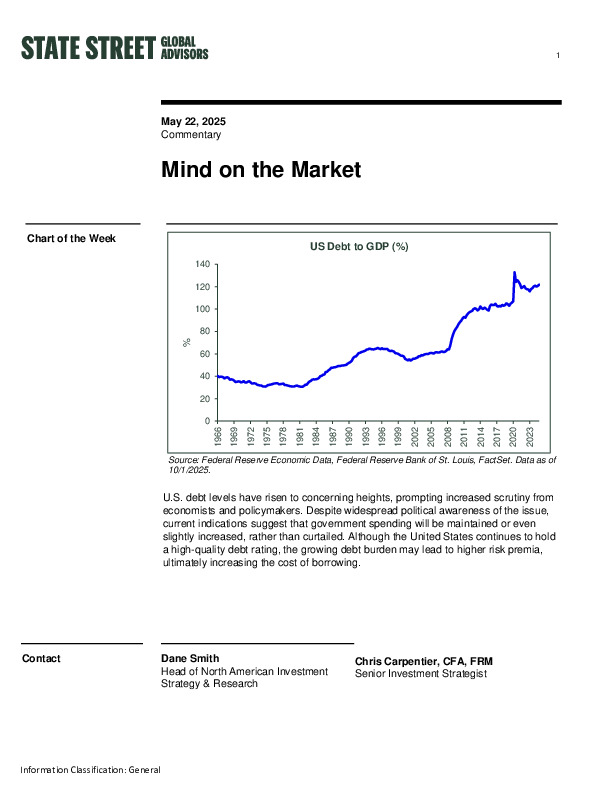

U.S. debt remains near 120% of GDP, with no signs of fiscal tightening despite mounting interest costs.

-

Elevated yields may shift preferences toward bonds and challenge traditional stock-bond correlation assumptions.

Explore how evolving debt dynamics could reshape your investment strategy.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.