Are Foreign Investors Coming Back to India? Flows Rise, But Fundamentals Lag

Martin Emery of GMO examines whether the recent pickup in foreign equity flows to India marks a structural shift or a temporary response to sentiment and market dynamics.

-

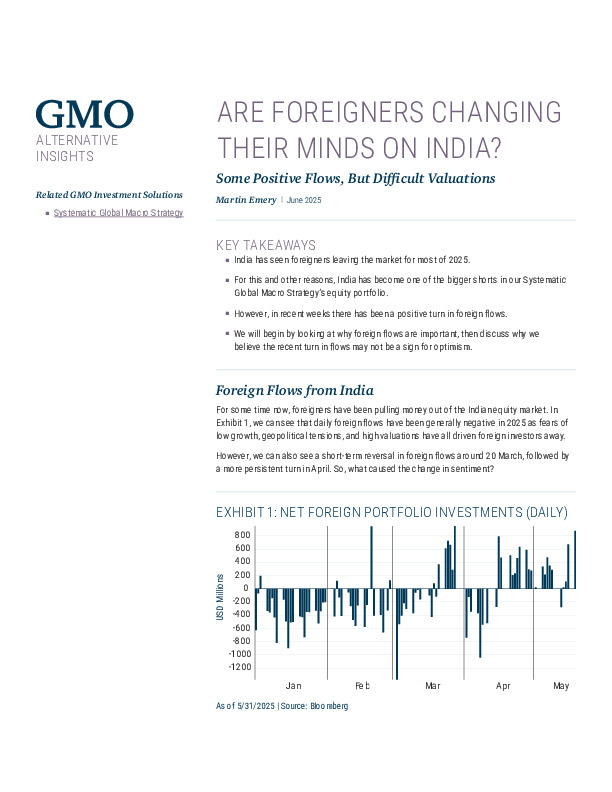

Despite a rebound in flows since April, India remains a short in GMO’s Systematic Global Macro Strategy due to stretched valuations and muted investor sentiment.

-

Foreign allocations have historically tracked momentum and risk appetite—both of which remain unfavourable in the current environment.

-

GMO’s models continue to project underperformance relative to other EMs, citing elevated profit margins and modest return expectations.

For a closer look at the disconnect between capital flows and fundamentals, read the full analysis.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.