Beyond the Surface - Why the Fed Should Normalize Now to Preserve Growth

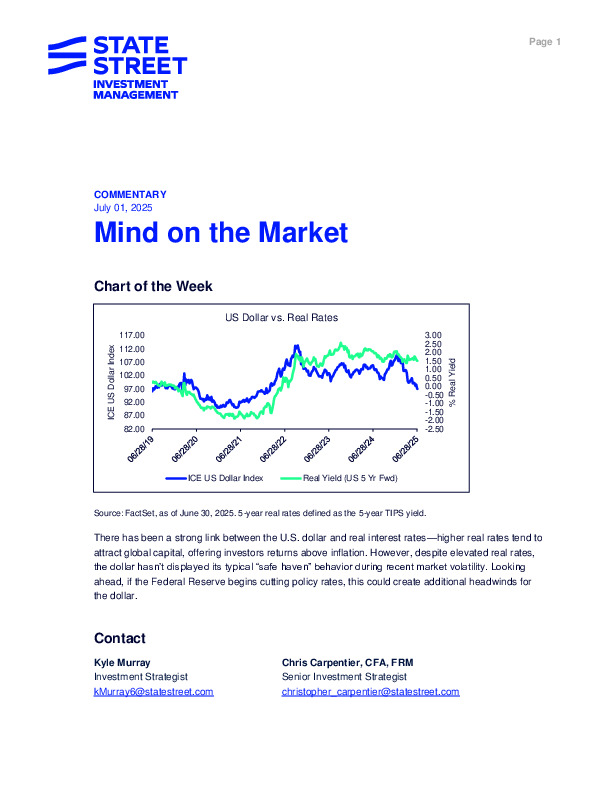

State Street Investment Management’s July 2025 “Mind on the Market” commentary outlines why current U.S. monetary policy is too tight in real terms and argues for timely normalization to prevent economic dislocation.

-

Despite resilient equity and labor markets, early financial stress is emerging—credit card delinquencies are at their highest since 2011, and jobless claims are rising.

-

Real policy rates remain significantly above neutral, quietly tightening financial conditions and reducing the economy’s margin for error.

-

A near-term rate cut is framed as prudent—not dovish—supporting the Fed’s soft-landing ambitions amid slowing credit transmission.

To understand why normalization—not stimulus—may be the Fed’s most strategic move, read the full report.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.