Deep Value, Rare Discount: Why Today’s Market Echoes 1999

GMO’s Asset Allocation team outlines a rare opportunity in value investing, supported by historical valuation metrics and a disciplined approach to relative pricing across U.S. and global equities.

-

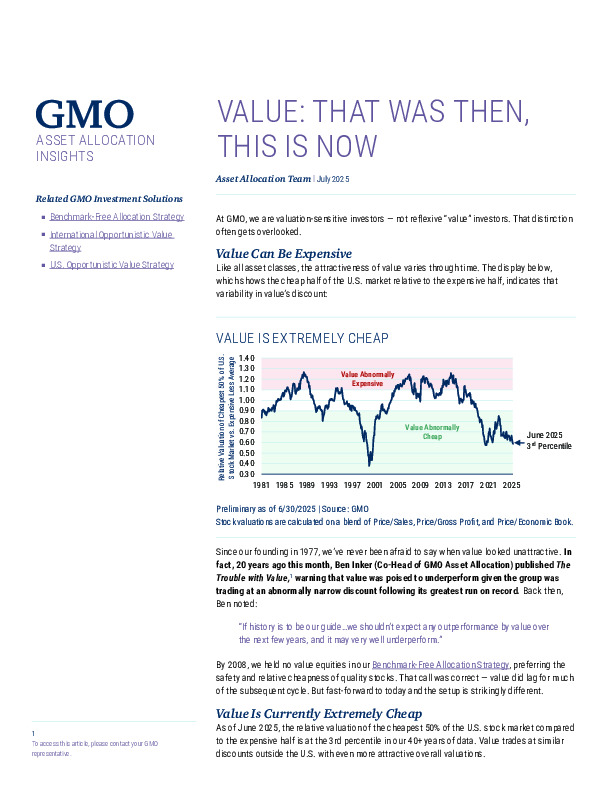

Extreme valuation gap: As of June 2025, U.S. value stocks trade at their 3rd percentile relative to growth—one of the deepest discounts in over four decades.

-

Selective opportunity: GMO emphasizes deep value (cheapest 20%) over broad value, citing stronger fundamentals and wider mispricing.

-

Tactical conviction: Current conditions mirror prior turning points (e.g., 1999, 2020), where valuation-aware positioning paid off.

What role should deep value play in a disciplined portfolio today? The full note explores the case for acting while the window remains open.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.