Rebalancing Over Chasing: How Allocators Are Staying Disciplined in 2025

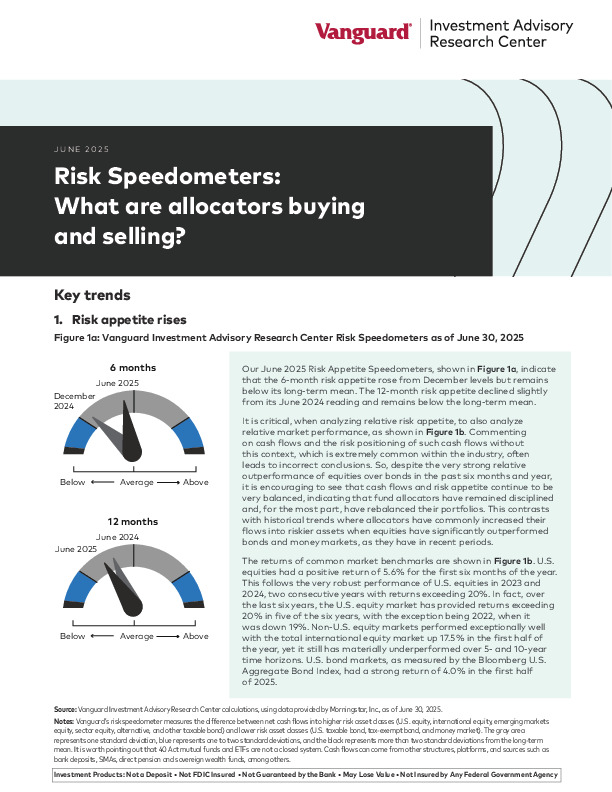

This Vanguard report, produced by the Investment Advisory Research Center, analyzes mid-year 2025 mutual fund and ETF flows to assess allocator behavior relative to market performance and risk appetite.

-

Despite equity markets delivering double-digit returns, investor cash flows favored fixed income and money markets—suggesting disciplined rebalancing over performance chasing.

-

Large Blend equities and Ultrashort Bonds topped inflows, while high-performing equity categories like Large Growth and Mid-Cap Growth saw persistent outflows.

-

Industry-wide allocations show a shift from trend-following to rebalancing behavior, with fixed income receiving 8x more flows than equities in the past year.

Want to understand how your peers are allocating risk and navigating volatility? Dive into the full report for a data-rich perspective on allocator behavior and positioning.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.