The European market for Long-Term Investment Funds (Eltifs) is poised for significant expansion, with Scope forecasting a potential tripling in volume to 30-35 billion euro by 2026 from 13.6 billion euro in 2023, according to the latest report from the European research and ratings firm. French investors, encourage by tax incentives, are driving the boom.

Despite a growth of approximately a quarter in asset volume last year, Scope noted that the increase fell short of high expectations and attributed this to unfavourable market conditions and a lack of regulatory clarity. A certain level of reluctance had previously been reported by some market participants.

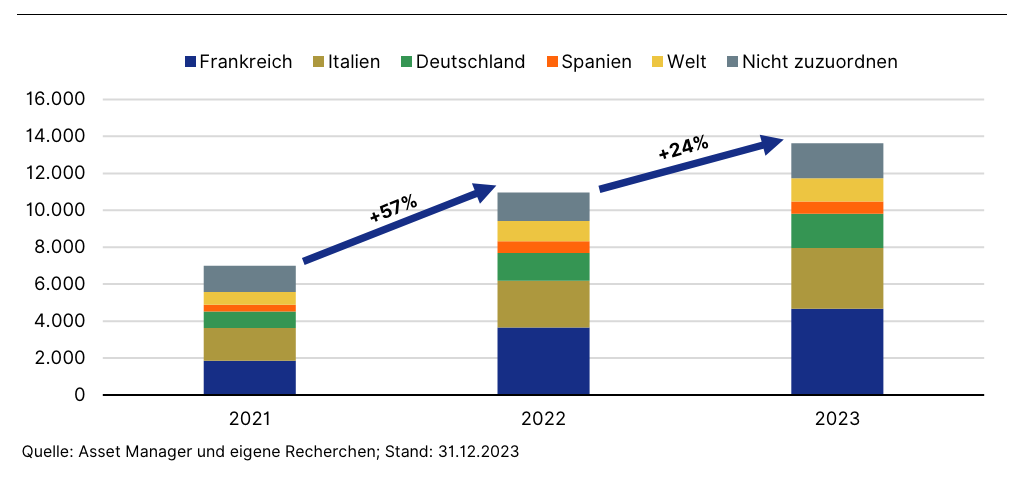

Eltif volumes by country

“While the growth in managed assets last year was solid, it still did not meet the immense expectations and hopes associated with Eltifs,” Berlin-headquartered Scope said, adding that “2023 was not a good year for private market investments” because investors were able to achieve attractive returns with interest-bearing investments.

Fund providers also held back in 2023 to wait for the Eltif-2.0 regime, which entered into force in January. “The new rules bring a range of facilitations for both providers and distribution. However, there is still no complete clarity on the exact implementation of some new rules, which further delays the launch of numerous products,” the agency said.

Despite the struggle over the design of technical regulatory standards, Scope said market participants are confident that the future of private market investments for broad investor segments belongs to Eltif. “The question of the permanent success of the ELTIF will depend crucially on the risk-return profile,“ it said, adding that robust insights into this matter will only develop over the coming years.

At least 20 new Eltifs expected

Total volume in the Eltif market increased by around a quarter last year, with private equity, infrastructure and private debt dominating the product offerings. Scope said it anticipates that at least 20 new Eltifs will enter the European market during the next twelve months. That is less that the 40 or so funds that are said to be in the pipeline in Luxembourg.

Currently, 95 Eltifs from 41 different asset managers are registered across Europe. Twenty of these were launched in the past year, with a similar number added in 2022. Of the 95 Eltifs, 85 have been actively marketed to investors so far, the firm said.

Scope estimates the aggregated volume of these funds to be €13.6 billion by the end of 2023. This represents an increase of around €2.7 billion compared to the end of 2022, corresponding to a growth rate of 24%.

The three largest funds are Meridiam Infrastructure Europe III SLP, klimaVest, and GF Infrastructures Durables SLP. Together these account for around a quarter of the total fund volume, Scope said. The top ten Eltifs represent nearly half.

French investors lead in Eltifs

French investors have invested the most capital in Eltif so far: 4.7 billion euro by the end of 2023. Italian investors come second with 3.3 billion euro, ahead of Germany (1.9 billion euro), and Spain (0.7 billion euro).

In terms of asset classes, the fund volume is fairly evenly distributed among private equity (31 percent), infrastructure (3 percent), and private debt (30 percent). The remaining fund volume is allocated to mixed strategies and real estate, Scope said.

The most active providers include Amundi, Azimut, BlackRock, BNP Paribas, Commerz Real, Generali Investments, Muzinich, Neuberger Berman, and Partners Group. Most Eltifs, 60, are registered with the Luxembourg supervisory authority CSSF.

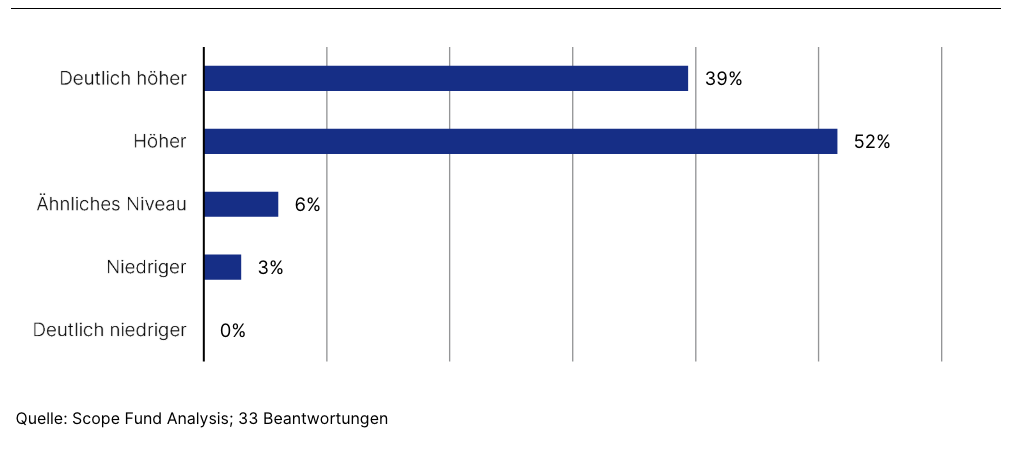

How will Eltif 2 affect the supply and demand dynamics of Eltifs?

Tax benefits drive Eltif demand in France, Italy

France has the biggest Eltifs, on average. Scope’s study shows that the average Eltif in France holds some 250 million euro in assets, compared to 150 million for Luxembourg Eltifs. Tax benefits drive demand for these products in France and Italy.

French investors were invested in a total of 31 Eltifs last year, with collective assets of 4.7 billion euro at the end of 2023, up 23 percent from a year earlier. Some 17 of these funds were registered in France, 13 in Luxembourg, and one in Italy.

Tax benefits clearly encourage French investors to invest in this type of funds. Retail investors enjoy tax advantages when they purchase Eltifs as part of unit-linked life insurance policies. If the policy is held for at least eight years, investors do not have to pay income tax on reinvested capital gains. Moreover, if the policy is paid out after eight years or more, there are additional tax benefits.

With 3.3 billion euro in 44 funds, Italy is the second Eltif market in Europe. Like France, tax advantages also encourage the market. Demand is characterised by private investors, with average investments per customer being generally under 100,000 euro. The main drivers are tax incentives for products that invest in the Italian economy or in innovation. Private individuals resident in Italy to benefit from exemptions on capital gains and inheritance tax, provided they observe a minimum holding period of five years.

KlimaVest is Europe’s biggest Eltif

Germany is Europe’s third market for these funds, with 1.9 billion euro held in 15 funds. With the exception of one fund registered at AMF in France, all funds marketed in Germany are domiciled in Luxembourg. German is home to Europe’s biggest Eltif, KlimaVest, which holds nearly 1.3 billion euro in assets, some 40 percent of which stems from Commerzbank’s real estate unit.

Germany’s Eltif growth is anchored in a broad distribution network, not tax benefits. Commerzbank offers KlimaVest and several regional banks have integrated these products into their marketing efforts, according to Scope, while the theme of renewable energy resonates with the zeitgeist, the spirit of the time. German Eltifs also allow investors to redeem their holdings daily up to 500,000 euro.

Luxembourg

Scope’s comprehensive report on the European Eltif market nevertheless again confirms that Luxembourg by far is the leading domicile for these private market vehicles, closely followed by France, Germany and Italy.

At the end of 2023, a total of 95 Eltifs were registered in Europe, 60 of which were registered at the CSSF. Out of the 20 new Eltifs registered in Europe last year, 18 were subject to supervision in Luxembourg. Spain and Italy’s supervisors each registered one new Eltif. The 60 Luxembourg Eltifs were offered by 41 European asset managers at the end of 2023.

Only 31 Eltifs actively distributed in 2023

Not all Eltifs registered are available to investors. Of the 95 registered Eltifs, 85 were still listed as being distributed by the end of 2023. Of these, 54 were actively distributed only until the end of 2022 and thus closed before the beginning of 2023. As a result, according to Scope, merely 31 Eltifs were actively distributed or subscribed to by investors in 2023. These 31 Eltif are offered by 19 different asset managers. The remaining ten out of 95 Eltifs were established in 2023 but have not yet been actively marketed. The distribution was scheduled to start only in 2024.

(This article has been updated to provide more details throughout.)