Navigating Trade Turbulence: AI Strength Supports U.S. Equities Amid Supply Disruptions

Authored by BlackRock Investment Institute’s senior research team, this report analyzes market impacts from escalating U.S.-China trade tensions and outlines strategic positioning for investors.

Key Insights:

-

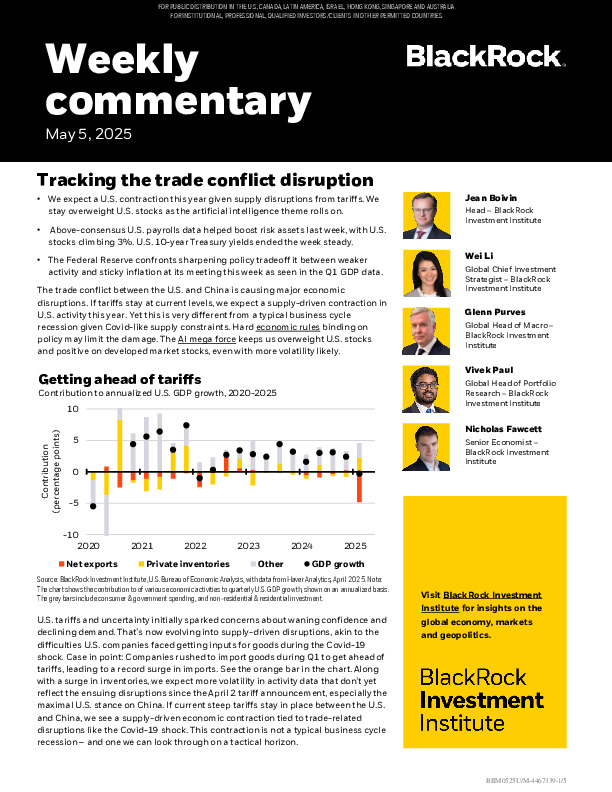

Supply-Driven Contraction Ahead: Tariff-driven disruptions expected to trigger a U.S. slowdown, though unlike typical recessions.

-

AI Mega Force Resilient: Despite trade risks, surging AI demand sustains U.S. equities, keeping them overweight in portfolios.

-

Fed's Policy Dilemma: Sticky inflation vs. weakening growth sharpens trade-offs; rate cuts likely limited.

Understand how global macro forces and AI tailwinds shape portfolio positioning, explore the full document.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.