Markets Rally, Risks Linger: Why Valuation and Trade Uncertainty Keep Us Neutral

This June 2025 Asset Allocation Outlook by Van Lanschot Kempen, led by Joost van Leenders and the Investment Strategy team, analyzes global macro and market trends driving current portfolio positioning.

-

Equities rose globally on easing trade tensions and strong Q1 earnings, but valuations—especially in the US—appear stretched relative to earnings revisions and bond yields.

-

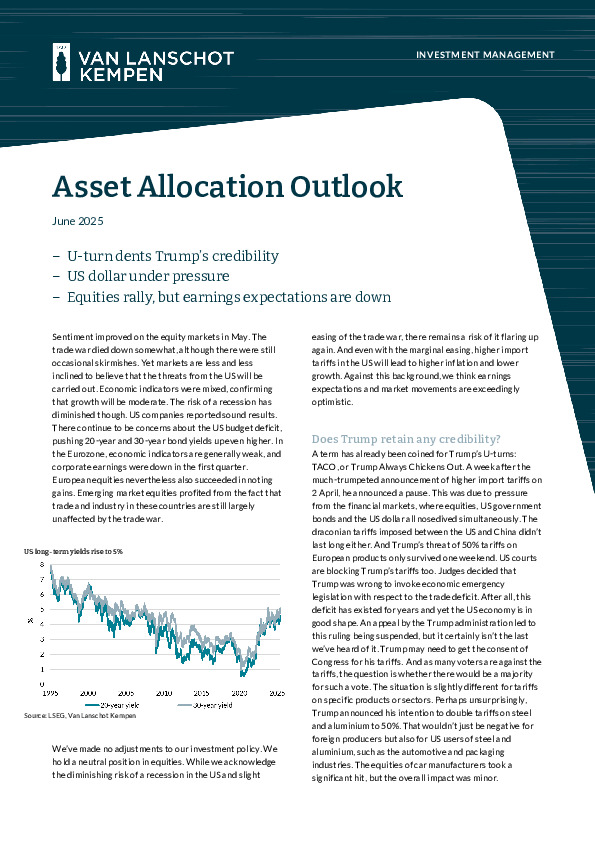

Economic data point to moderate growth in the US and Eurozone, while China weighs on emerging markets; inflation is cooling, yet policy divergence continues.

-

Given persistent geopolitical and valuation risks, the team maintains a neutral stance on equities and prefers government bonds over credits.

Explore the full report for detailed positioning, risk assessments, and regional breakdowns across all major asset classes.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.