Three Reasons To Consider Dedicated Emerging Market Debt Exposure

The report highlights the advantages of a dedicated allocation to emerging market debt (EMD), emphasizing its strong historical returns and diversification benefits.

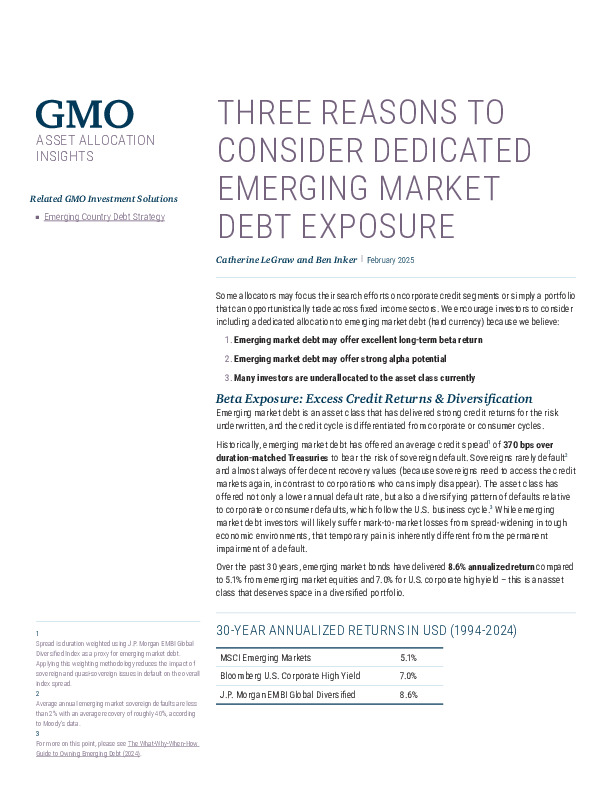

- Attractive Returns: Over 30 years, EMD delivered 8.6% annualized returns, outperforming emerging market equities and U.S. corporate high yield.

- Alpha Potential: Active management in EMD has consistently outperformed benchmarks due to market inefficiencies.

- Underallocation Risk: Many investors have limited exposure, missing out on diversification benefits.

Explore how EMD can enhance portfolio performance—read the full report for deeper insights.

Register or log in to continue reading. Investment Officer is an independent journalism platform for professionals working in the Luxembourg investment industry.

A subscription is free for professionals working at banks and independent asset managers.