Three Reasons To Consider Dedicated Emerging Market Debt Exposure

The report highlights the advantages of a dedicated allocation to emerging market debt (EMD), emphasizing its strong historical returns and diversification benefits.

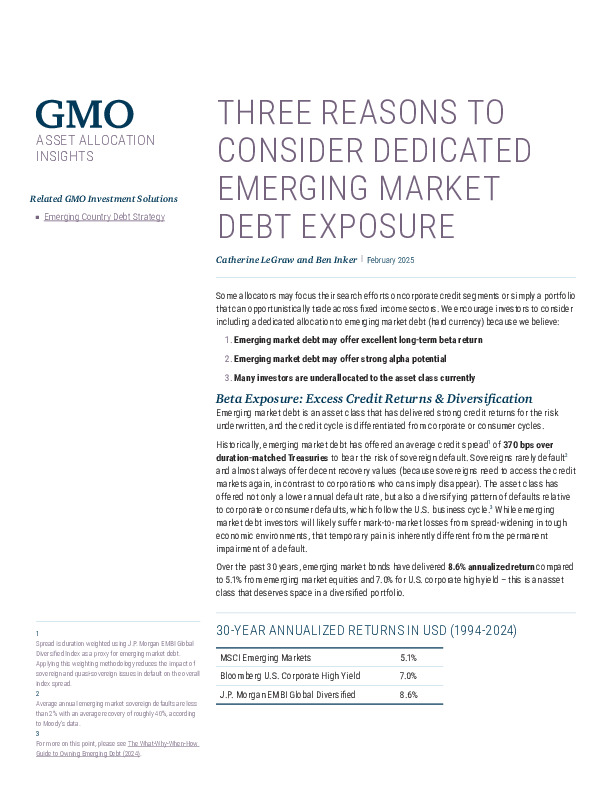

- Attractive Returns: Over 30 years, EMD delivered 8.6% annualized returns, outperforming emerging market equities and U.S. corporate high yield.

- Alpha Potential: Active management in EMD has consistently outperformed benchmarks due to market inefficiencies.

- Underallocation Risk: Many investors have limited exposure, missing out on diversification benefits.

Explore how EMD can enhance portfolio performance—read the full report for deeper insights.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.